An Overview of Precious Metals Performance In 2022

Published on 18th January 2023

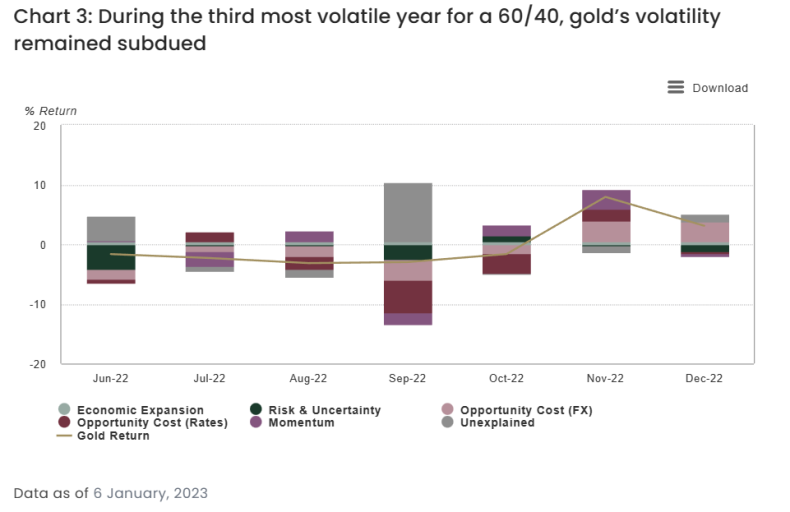

Precious metals have long been considered a safe investment choice in an inflationary environment and it proved to be true in 2022 as well. While most asset classes performed worse than expected last year, precious metals proved to be the exception.

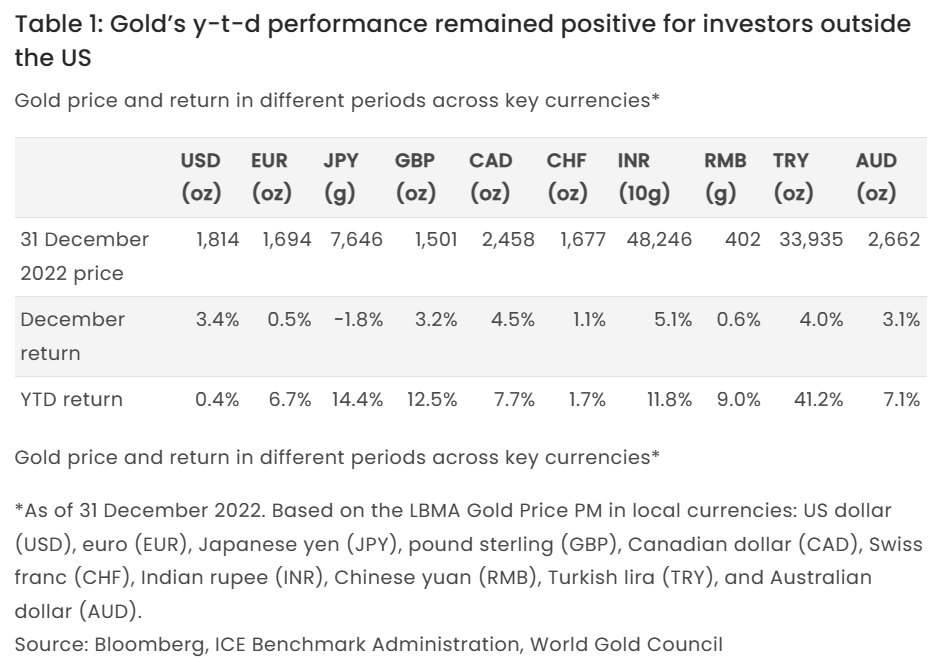

While gold managed to retain its value – despite a few ups and downs – throughout the year, silver was up nearly 3% and platinum was up nearly 11% (all in USD terms). Experts say that precious metals emerged as the macroeconomic winner last year – in relative as well as absolute terms.

Performance of Various Asset Classes in 2022

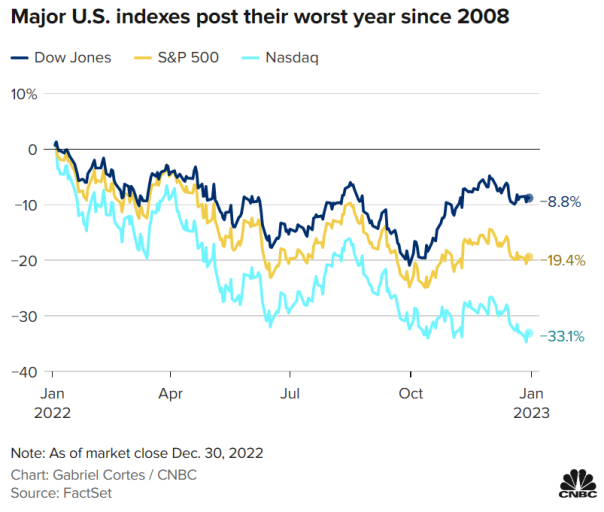

Data shows that 2022 was a horrendous year for traditional asset classes like stocks and bonds as well as alternative assets like cryptocurrencies – due to a combination of factors including the war in Ukraine, skyrocketing inflation, and aggressive interest rate hikes by the Federal Reserve.

By the end of 2022, the S&P 500 was down by nearly 20% – its worst performance since 2008. Things were so bad that hedges – which have traditionally been the go-to strategy for investors to protect against downside risks – did not work due to the below than expected growth in the US.

The bond market, on the other hand, had its worst year ever. The Total Bond Index – which tracks low-risk, investment-grade bonds – lost more than 13%. Intermediate-term Treasury bonds lost over 10%, which is the biggest decline since 1926. 30-year Treasury bonds lost 39%, which has never happened in over 250 years.

Alternative assets like cryptocurrencies also sinked like never before. Two of the most valuable cryptocurrencies in the world today – Bitcoin and Ethereum – plummeted in value by more than 70% and 65% respectively.

Amidst this backdrop, the performance of precious metals in 2022 looks all the more impressive.

How Precious Metals Performed in 2022

Performance of Gold against Global Currencies in 2022

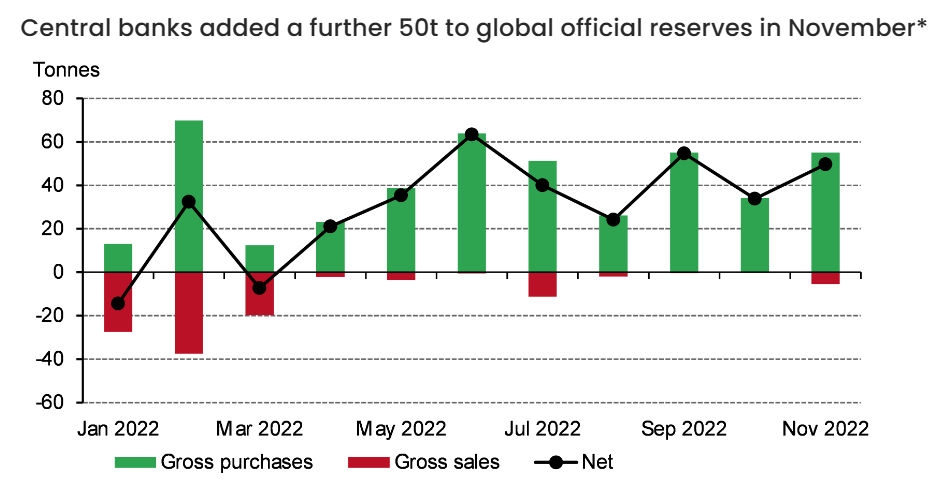

Gold Purchases by Central Banks in 2022

Demand for Precious Metals in 2023 – What We Can Expect

Many experts believe that the demand for gold will increase in 2023 due to a number of factors including the reopening of China after several months of Zero-Covid lockdowns, the weakening of the dollar, a less aggressive approach towards hiking interest rates by the Federal Reserve, and the possibility of a global slowdown. The Chinese New Year celebrations are expected to increase the demand for gold significantly in the coming days.

If the current economic conditions persist for some time – which is a real possibility – investors might reduce their traditional asset holdings and invest significantly in gold. In such a scenario, gold might be considered ‘the only asset in town’, which is what happened back in the 1970s. Many experts believe that the price of gold might reach anywhere between US$2,500 and US$4,000 over the next 12 months.

Other precious metals are also expected to perform a lot better in 2023 than they did in 2022. Silver is expected to perform as well as or better than gold in 2023, due to the increased demand for silverware, jewelry, electric vehicles, and photovoltaic cells.

Platinum, which has a wide range of applications, is expected to continue its impressive performance this year. Experts say that the demand for platinum is likely to increase by 19%, but the supply is likely to increase only by 2%.

Let J. Rotbart & Co. Assist in Increasing Your Precious Metals Holdings today!

At J. Rotbart & Co, we have a decade of experience in buying, selling, financing, assaying, and storing precious metals. We have a team of world-renowned experts who are committed to meeting the precious metal needs of our clients.

We can provide you with the expert advice you need on investing in precious metals and we can also help you with buying, selling, trading, and storing precious metals. Get in touch with us today using our online contact form and schedule a free consultation with one of our investment experts.

Let us know your thoughts and comments via our social media accounts, email or the form below.