Building a Successful Precious Metals Portfolio

Published on 10th April, 2024

The 60/40 portfolio – consisting of 60% equities and 40% bonds – has long been considered the gold standard for diversifying your investments. The idea behind the 60/40 allocation ratio is to combine the growth potential of equities with the stability of bonds, so that you can get consistent, risk-adjusted returns in the long term.

With that said, in the current economic and geopolitical landscape, the 60/40 portfolio might not be the ideal investment strategy for investors anymore. In the post-pandemic era, the meaning of ‘diversified portfolio’ has changed greatly and you can no longer diversify your portfolio by investing in equities and bonds alone. It’s vital to look for alternatives such as precious metals to build a resilient portfolio that can withstand short-term as well as long-term shocks and provide consistent returns.

Why the 60/40 Portfolio Might Not Be the Best Bet for Investors Now

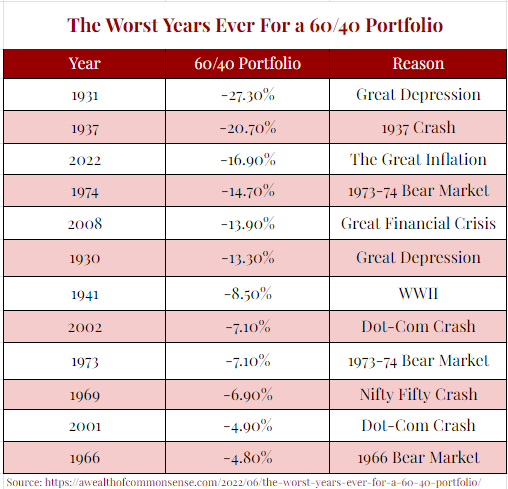

One of the most important reasons why the 60/40 portfolio might not work in the present market conditions is that it cannot withstand the combined impact of inflation and rising interest rates. The negative correlation between stocks and bonds, which the 60/40 portfolio relies on, tends to inverse during periods of high inflation. It’s exactly what happened in 2022, when both equities and bonds performed poorly and the 60/40 portfolio had its worst year in a very long time.

With inflation still persisting above 3% and the Fed reluctant to cut interest rates, sticking to a 60/40 investing strategy might be a bad idea – especially in the short term.

Experts say that 60/40 portfolios tend to perform similar to 100% equity portfolios in the long term, as their returns are primarily driven by the performance of equities. It’s one of the reasons why they are more vulnerable to market crashes than many people think.

Another critical flaw in the 60/40 investing strategy is the lack of inflation-hedge assets like precious metals. With the US inflation rate still remaining well above the Fed’s target of 2%, it’s more critical than ever to build a portfolio that can resist inflationary pressures and deliver reliable returns.

Precious Metals in Your Portfolio – Why It Matters Now More Than Ever Before

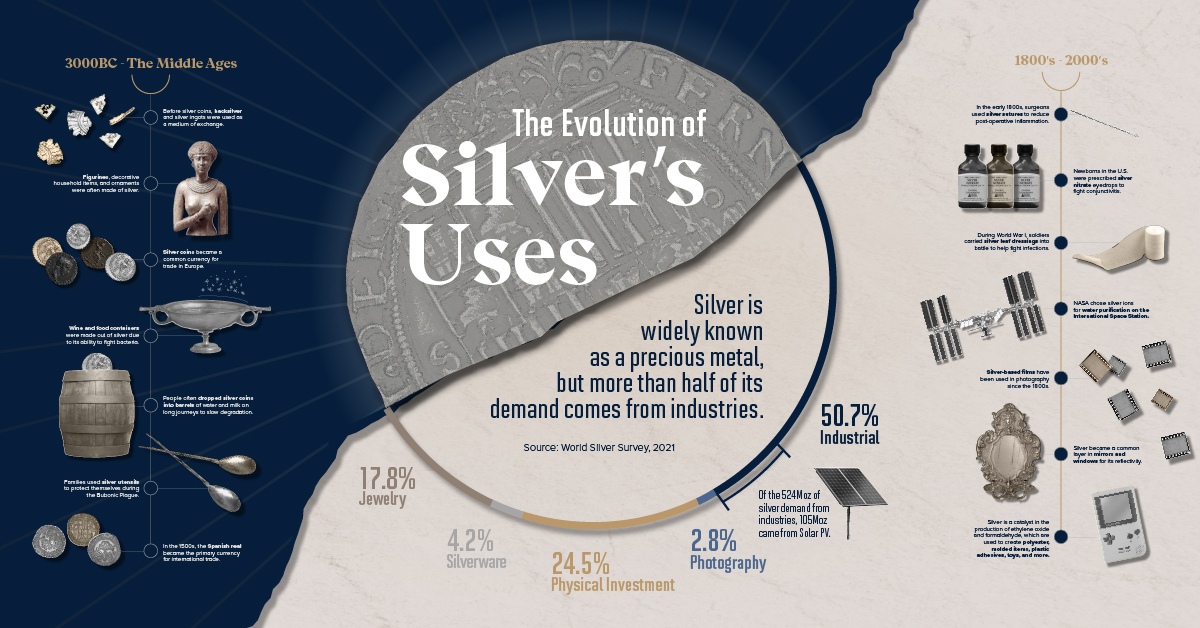

With persistent inflation and rising geopolitical tensions, precious metals are seen as a reliable safe haven asset by many investors. Currently, gold prices have soared past $2,300 per ounce – largely due to the escalating tensions in the Middle East and the ongoing war between Russia and Ukraine. Silver is also performing well and its price per ounce has increased by more than 10% since the beginning of the year. Some experts believe that 2024 could be a big year for silver and it could breach the $30 mark.

With this being the case, it makes immense sense to add precious metals to your portfolio – regardless of your investment goals.

How Precious Metals Can Benefit Your Portfolio

Risk Mitigation

Data shows that historically, gold has delivered stable returns during periods of economic uncertainty. This is largely due to the fact that gold’s correlation to traditional asset classes like equities and bonds tends to be very low or negative. Over the last four decades, gold has consistently outperformed most other asset classes during economic and geopolitical crises like the Gulf war, September 11 attacks, and the subprime meltdown of 2008.

Hedge against Inflation

Gold is an excellent hedge against price inflation as well as monetary inflation (currency devaluation). It has a long track record of being a reliable store of value and preserving wealth during inflationary regimes.

Consistent Returns

Data shows that over the last 50 years, gold has performed consistently well and has delivered an average annual return of 8%. During this time period, gold has performed exceptionally well and delivered greater returns from time to time. For instance, gold’s rate of return in 2020 was 25%.

Liquidity

Gold is highly liquid and can be easily bought and sold whenever you want. This liquidity allows you to quickly adjust your exposure to gold based on market conditions and your investment goals.

What Professional Investors Say about Portfolio Diversification

Professional investors often emphasize the need for building a diversified, resilient portfolio, as it is the only way to get consistent, reliable returns in the long term. Many of these investors say that precious metals – gold in particular – can be a poignant addition to any investment portfolio.

One of the most well-known proponents of investing in gold was the late Harry Browne, who allocated 25% of his portfolio to gold. His portfolio – commonly referred to as the permanent portfolio, fail-safe portfolio, or bulletproof portfolio, was designed to perform well in any kind of economic environment.

Yet another proponent of gold is Ray Dalio – the billionaire investor who owns Bridgewater Associates. Dalio recommends investing in a diverse range of assets which have very low correlation. He is particularly known for his affinity for gold as an investment, which he calls ‘timeless and universal’. He says that investors should allocate anywhere from 5% to 10% of their portfolio to gold.

Data shows that 30% of institutional investors in the US have added gold to their portfolio in order to protect against market volatility and get better risk-adjusted returns in the long term.

Investing in precious metals is a time-tested way to protect your portfolio against known and unknown market risks and preserve your wealth. Whether you are looking to invest in gold, silver, platinum, or palladium, the precious metals experts at J. Rotbart & Co can help you.

With decades of experience in precious metals trading, logistics, and management, we are equipped to handle all your precious metal needs. We offer the highest quality precious metals at competitive prices. We also offer a wide range of other services including authentication and assaying of precious metals, storage, lending and finance, and investment advice.

Whether you are a beginner investor looking to build a portfolio or an experienced investor looking to diversity your portfolio, we can help you invest in the right precious metals.

Get in touch with us today using our online contact form to schedule a free consultation with one of our precious metals experts.