Do you think gold is not performing well in 2022? Think again.

Published on 21st November 2022

Gold has long been held as a safe haven commodity that investors rely on to protect their wealth, and governments still keep large stocks of it as reserves to protect their countries’ currencies. Globally, gold is mostly traded in US dollars and as a result, there is a direct correlation between the price of gold and the US dollar.

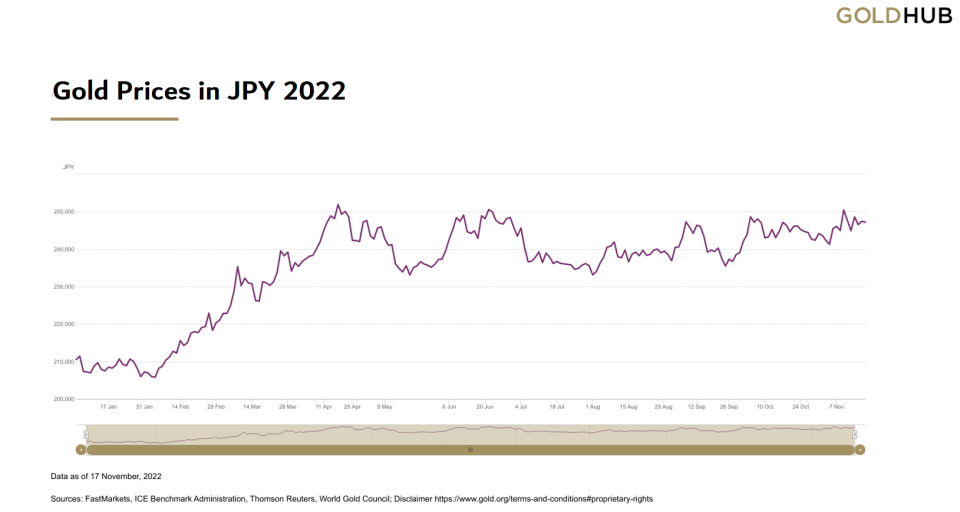

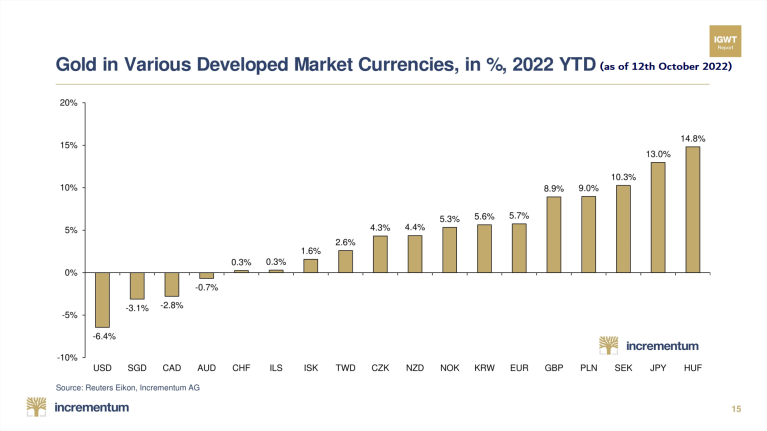

However, besides the USD, interest rates, inflation, supply and demand also play a large part in impacting the value of the precious metal. But amidst this chaos-filled year, the gold price has shown great promise against other global currencies such as the Yen, Euro, Great British Pound and others as seen below.

Gold prices year-to-date (as of 18 November 2022)

XAU/USD: – 3.61% XAU/JPY: + 16.35% XAU/EUR: + 5.47% XAU/GBP: + 8.72%

XAU/SGD: – 2.38% XAU/HKD: – 3.95% XAU/CAD: + 1.14% XAU/CHF: + 0.21%

This article will discuss how gold has maintained its image as a hedge and wealth preserver by assessing its price performance against these major currencies in 2022.

How have the major currencies performed in 2022?

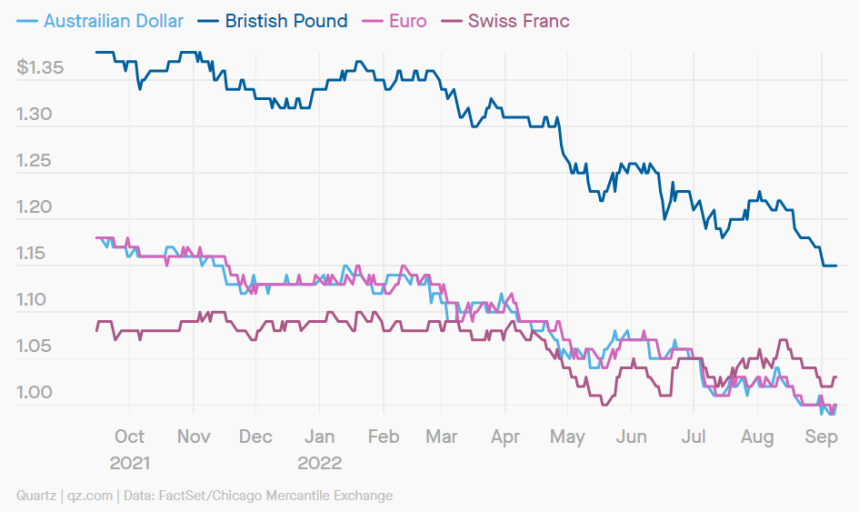

AUD/GBP/EURO/CHF Performance vs USD index 2022

Cross-border transactions, as well as global commodities trading, are priced in USD, even if the US is not involved. Current crises, including delayed or ceasing energy supplies due to the Russia-Ukraine conflict, have caused rising inflation and increased recession risks, especially in Europe. In response to these issues, the US Federal Reserve raised its interest quickly and aggressively to combat inflation, much more so than other central banks, contributing to the USD strengthening. What made the situation worse was when the UK, traditionally also a strong economic player, announced a series of tax cuts and other measures that backfired, pushing the GBP down to historic lows against the USD.

Currencies are tied to their countries’ trade. If a country imports more than it exports, then its currency may be worth less. So, the more it exports, the more valuable its currency is. Continuing this to gold, if a country exports gold or has gold reserves, its currency’s value could increase with the price of gold. Central banks could make this issue worse as they try to purchase gold with their fiat currency – if they print more of their money to buy gold, they risk increasing the supply of such currency and lowering its value.

Furthermore, emerging markets, many with high USD debts, have not been able to battle inflation. Argentina attempted to do so by banning the import of nonessential goods, such as whisky. Nigeria has seen rising food prices as its falling currency pushes inflation to 20%. Sri Lanka defaulted on its foreign debts and is still trying to negotiate lower repayment costs. Specifically regarding the Philippines, the peso (PHP) has seen an almost 16% change in value in just a year.

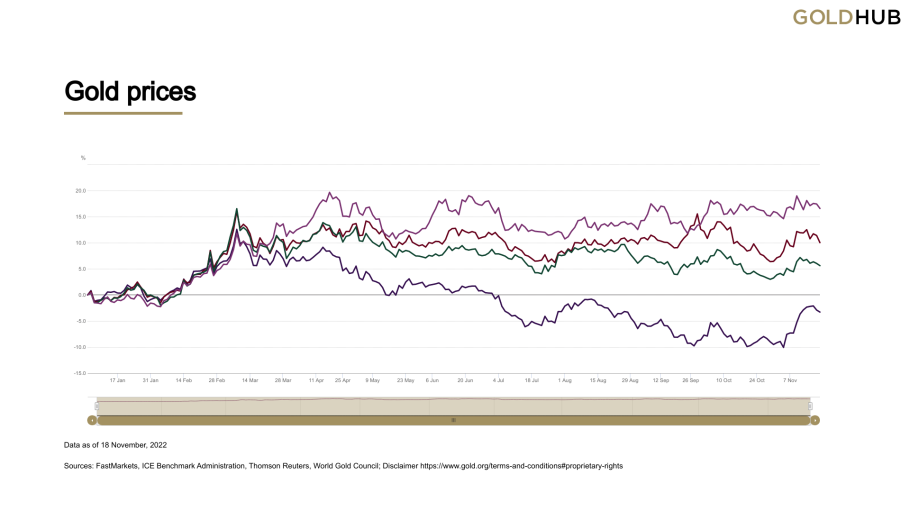

Gold price performance vs expectation YTD 2022

With record-high inflation, a slumping stock market, and a slow global economic growth, gold enthusiasts around the world believed the price of gold would reach new highs especially due to the war between Ukraine and Russia. However, the gold price performance (USD) of -3.61% has been rather disappointing in 2022 as it has been impacted heavily by the rising interest rates and the strong US dollar after reaching close to all-time highs in February earlier this year.

Looking back in history, we can point out the period between 2008 and 2010, when gold doubled in value, meaning that it took twice the currency to purchase the same amount of gold. Also of note is when gold surged 26% against the GBP but only 6% against the USD after the Brexit vote on 23 June 2019. Seeing how currencies fluctuate, it could be said that gold is the best protection against currency risk, especially in this post-Brexit era and in the face of a possible recession in various countries worldwide as they try to increase the value of their currencies with several rate hikes.

Gold price performance as of 18 November 2022 in USD (Dark Purple), EUR (Green), GBP (Red), JPY (Lavender)

Price performances of gold against the major currencies around the world

In 2022, the US dollar gained over 10% in value and major currencies around the world took a major hit such as the GBP, EURO, JPY, etc. With record-high inflation and rising interest rates, holding cash in these currencies further reduced the wealth of many around the world. However, amidst such downturns, investors around the world looked towards gold as a weather preserver and a hedge against inflation.

This phenomenon was further confirmed as the gold price rose over 6% in EURO, nearly 15% in GBP and over 17% against the JPY. Although many have said that gold has underperformed in 2022, in major parts of the world, gold has done exactly what was requested of it, and the data shows that gold is pertinent to a portfolio during times of economic downturn and when the financial markets take a hit such as the S&P 500 being down over 15%, gold has performed exceptionally when considering its price against the other major currencies besides the USD.

With rising inflation and interest rates, stable currencies like the Singapore and Hong Kong dollar also saw volatility but as seen below, the price of gold maintained its role as a wealth preserver in 2022 for the Singapore and Hong Kong market.

Gold price performance against the Hong Kong Dollar in 2022 as of 18th November 2022.

Gold price performance against the Singapore Dollar in 2022 as of 18th November 2022.

Summary

Let us know your thoughts and comments via our social media accounts, email or the form below.

LinkedIn | Facebook | Twitter | Instagram | YouTube