Gold 2019: What Happened and What to Expect in 2020

Gold 2019: Heightened geopolitical uncertainties made quite an impact on global markets in 2019, including on gold as an investment. Unresolved Brexit negotiations, US-Russia diplomatic tensions, and the ongoing US-China trade war were just a few facets of the “new cold war” involving big and powerful nations with global economic consequences. Such turbulence inevitably added stress to monetary policies and investment strategies for countries, businesses, and individual investors everywhere.

These uncertain international economic and financial landscapes caused many to take protective actions. Regardless of their size, from central banks to individuals, investors were actively diversifying their portfolios with physical gold and other financial instruments derived from it. Purchasing gold bullion bars and coins was a way to protect and shield wealth last year, especially since paying storage fees for holdings an asset such physical gold makes more sense than paying negative yields on bonds. As we enter 2020, we should look back at how this precious metal fared in 2019. By evaluating developments and trends from last year, we can anticipate the future of gold investment for this coming year.

Gold 2019 Developments and Trends

1. Central Banks Noticeably Increased Gold Purchases

- Central banks procured 12% more gold than in 2018, with net purchases of 547.5 tonnes.

- After years of not buying gold, Hungary, the Philippines, Colombia, and Argentina started showing increased interest.

- The People’s Bank of China and Russia’s central bank-led the trend of heavily accumulating the precious metal. Their purchases, combined with Poland’s, made up 60% of gold purchases by central banks last year.

- A majority of central banks surveyed by the World Gold Council in July 2019 expect global central bank reserves to increase over the next year, with 11% of the emerging and developing nation’s banks intending to buy as well.

2. Gold Price Appreciation

- Gold 2019 began priced at USD 1,290 per ozt and climbed to USD 1,517 per ozt by December 31st – an outstanding 17.4% surge.

- It reached record high prices in various currencies such as the British Pound, Japanese Yen, Indian Rupee, and Canadian Dollars.

- Price appreciation was also triggered by easing monetary policy and negative yield debt.

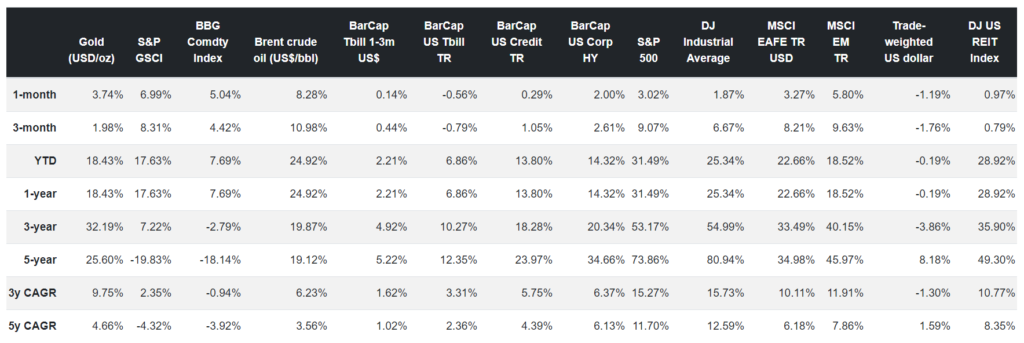

Returns of gold compared to other major assets 2014-2019 (as of December 31st, 2019)

Source: World Gold Council

3. Fluctuating Demand for Physical Gold

- Price volatility and expectations of weaker economic growth resulted in a softer consumer demand near term. In the first three quarters of Gold 2019, there was a 27% decline year-over-year in demand for physical gold bullion bars and coins.

- There was an increased appetite in ETF vs physical holdings. In October, for example, an all-time high was reached by the gold-backed ETF holdings. This happened as investors balanced between high equity markets and uncertainty.

2020 Outlook and Recommendations

- Considering the ongoing geopolitical and economic risks that are likely to feature in 2020, we can expect a continued rise in gold prices.

- The tariffs imposed by the US, even once any deal is achieved with China, would still impact markets and will probably keep pushing prices higher.

- Low interest rates will likely continue supporting demand for precious metal investments.

Market analysts believe 2020 is a promising year for gold. As reported by Market Realist, investors are switching to safe-haven investments like gold as a result of the uncertainties in the market. Our Managing Partner, Joshua Rotbart, agrees and strongly recommends looking at gold strategically, as an alternative currency and as a hedge against systematic risks. He also supports the idea of holding physical gold for the medium to long term.

With all the above-mentioned factors likely to continue in 2020, it would be best to consult experts on how to best protect your wealth against uncertainties. Firms like J. Rotbart & Co. can help you buy physical assets through our bespoke precious metals services. We can guide you through the process from purchasing to safekeeping. Feel free to message us at [email protected].

Click here to watch our Managing Partner, Joshua Rotbart, elaborate on this topic and more in his Bloomberg Markets: Asia interview.