Not out of the woods yet – The outlook for precious metals in 2024

Published on 26th January, 2024

The past year has been pivotal for the price of gold. After three long years of consolidation, gold has finally managed to have a quarterly close above the critical number of 2000 USD an ounce. Since it happened in the 4th quarter, it is also considered as an annual close. This event should not be taken lightly. Round numbers have a strong psychological effect, and there are many investors around the world who were waiting for this signal, in order to plow large amounts of money into the yellow metal. But although we are optimistic regarding the prospects of gold and silver, we are still aware of the hurdles which they need to cross, and the dangers which await them down the road. Here is our outlook for the precious metals during 2024. As always, the great unknown which we need to deal with is central bank policy. As far as precious metals are concerned, this factor seems to trump any other consideration. Since 2021, the Federal Reserve has been trying to battle inflation by raising its benchmark rate and performing quantitative tightening. This made short term government debt much more attractive, and put the price of gold and silver under pressure. As a result we’ve seen their prices moving sideways, in a very frustrating correction. But during 2023 there was a growing consensus in Wall Street, that inflation has been defeated, that the tightening cycle is over, and that the Federal Reserve is expected to cut rates during 2024. This allowed the S&P 500 to rally and to reach new all time highs. This also allowed gold to have such a strong annual close.

But a higher than expected non-farm payrolls figure in December, and the inflation rate which ticked up to 3.4% per year put a damper on the celebration. Wall Street traders are now less certain that the Fed will actually cut rates in March1, and the probability for that has dropped below 50%. They are still expecting rate cuts to take place in May and June, but the outlook is more ambiguous than it was just a month ago. So long as the labor market in the US remains strong and inflation is elevated, the Fed doesn’t have a good enough reason to cut rates. If the Federal Reserve decides after all to maintain their policy of “higher for longer”, then the rally we hope to see in precious metals may be postponed by another year. Gold and silver have a narrow time frame to shine, between now and the month of May, before “summer doldrums” set in, and the price begins to stagnate due to seasonality2. As you can see, precious metals are not out of the woods yet.

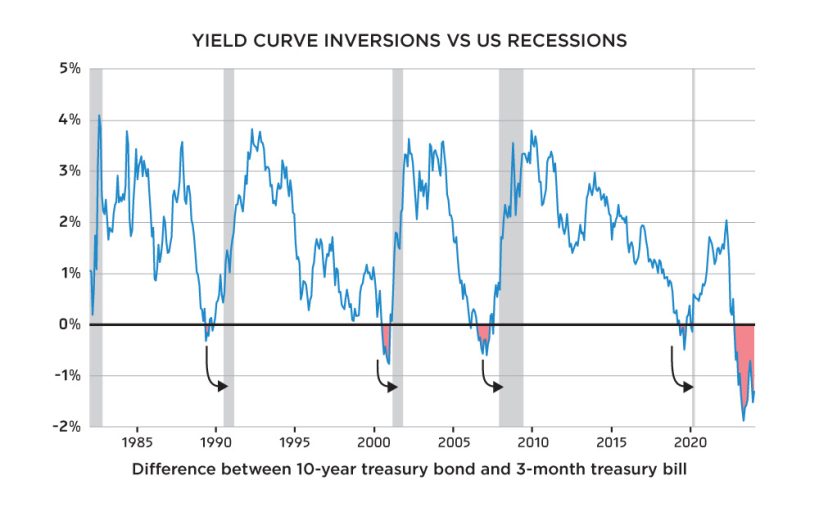

The main thing that can change that is the possibility of a recession. As you may recall, there is an indicator which is known as the “yield curve”. It is calculated as the spread between the yields of a 10-year treasury bond and a 3-month treasury bill, and for some unknown reason it remains the most reliable indicator for a coming recession in the US. Whenever this spread becomes negative, or in other words the curve becomes inverted, a financial crisis is expected to happen within 6 to 12 months3. This mysterious signal has flashed red before every recession in living memory, including the dot-com bust in the year 2000 and the sub-prime crisis of 2008. There was even a slight inversion in the summer of 2019, shortly before the eruption of COVID-19 (although we still don’t understand how the bond market could possibly predict a pandemic). Lo and behold, during 2022 the yield curve has inverted yet again4. This has led many economists to predict a recession during 2023, but this recession never materialized, and 2023 turned out to be a great year for the stock market.

If we do get a financial crisis during 2024 and the stock market crashes, there is also a high likelihood that precious metals will experience a sharp correction. This happens due to the initial drop in industrial demand. We have seen this happen in 2008, when the price of gold dropped from 1000 USD to 700 USD per ounce in a matter of a few months. It happened again in March of 2020, when the price of gold fell from 1700 USD to 1450 USD within 6 trading days. Such an event can be very scary for precious metals investors, but they shouldn’t lose their nerves, because it usually doesn’t last long. Once the Federal Reserve realizes the gravity of the situation, we can expect them to intervene in the markets, slash interest rates all the way back to zero, and embark on a new QE program. This type of easing leads to an increased investment demand for gold and silver, and their price quickly recovers.

One may argue that since the rate of inflation is still higher than the Federal Reserve’s target of 2%, they may be reluctant to ease so aggressively. In our opinion that is not the case. The Federal Reserve considers inflation to be a long term problem, whereas a deflationary collapse poses an immediate threat to the financial system. In the event of such a crisis, we believe that the Fed will throw caution to the wind. If in 2020 it printed 5 trillion USD in order to bail out the system8, next time it may need to print 10 trillion in order to achieve the same effect. The instant increase in the money supply will be mind boggling, and so will be the surge in the prices of gold and silver. As the only available assets which are both useful, scarce, and relatively cheap, they could be the prime beneficiaries of such an intervention.

Judging by the events of the past four years, another round of easing by the Federal Reserve will surely lead to a surge in inflation. But if in 2020 inflation started to rise from zero, this time it will be rising from a higher level. This means that it also has the potential to top at a much higher rate. This dynamics is reminiscent of what has happened during the 1970s, when under the leadership of Arthur Burns the Federal Reserve was repeatedly too late to raise rates, and too quick to cut them down again, whenever inflation has subsided. As a result, the US has experienced three distinct “waves” of inflation, each of them worse than the previous one. The public, which is now more experienced than before, will probably try to front-run this inflation, and begin to hoard the commodities that it needs in its daily life. This increase in the velocity of money can amplify the inflation, even when the money supply is not growing at all. Another factor which may exacerbate the inflation in the US is the growing trend of de-dollarization.

We maintain that eventually, this persistently high inflation will lead to an increased demand for precious metals. History is quite clear on the matter. There has never been a case of prolonged inflation in which the public did not use gold and silver in order to protect its savings, and we find it hard to believe that this time will be the first. Indeed, in our day and age we have computers, we have the internet and we have crypto-currencies. But there is still a large swath of the population, especially the older folks, who distrust these technologies, and would rather own physical precious metals. For all we know, 2024 may be the year in which this trend is put in motion. And once the ball is rolling, who knows how far it can go.

At J. Rotbart & Co, we go above and beyond what most dealers do in order to provide a secure and satisfactory investment experience for all our clients. Wide selection of high-quality precious metals products, our transparent & competitive pricing and successful track record set us apart from other dealers.

We strive to provide a positive buying and selling experience to all our clients. We are responsive to customer inquiries, address concerns promptly, and offer support throughout the buying and selling process. Contact us today by filling out our inquiry form or email us at [email protected] for all your gold and other precious metal needs.