Platinum And Palladium – Metals To Watch Out For In 2023?

Published on 17th June 2023

With growing demand and supply deficits, platinum and palladium could be the precious metals to watch out for in 2023! Due to the energy crisis in South Africa, where 70% of the world’s platinum and 40% of the world’s palladium is mined, the supply of these precious metals is expected to decline sharply this year. The ongoing war in Ukraine has also led to a decline in platinum and palladium production in Russia, which has also contributed to the global shortage of these precious metals.

The demand for platinum and palladium, on the other hand, is set to increase significantly this year – largely due to their applications in the automotive sector.

How did Platinum and Palladium Perform in 2022?

The best precious metals performer of 2022 was platinum, up nearly 11% on the year as it began the year around US$ 965 an ounce and ended at around US$ 1,068 an ounce. According to the World Platinum Investment Council, total supply was down 12% whilst automotive demand for 2022 was up 12% year-on-year.

Palladium on the other hand experienced increased volatility due to the war in Ukraine. Whilst it started the year at US$ 1,719 per ounce, it ended the year around US$ 1,790 an ounce. This was largely attributed by the rising energy costs and supply chain issues for the metal throughout the year.

Platinum and Palladium Forecast for 2023

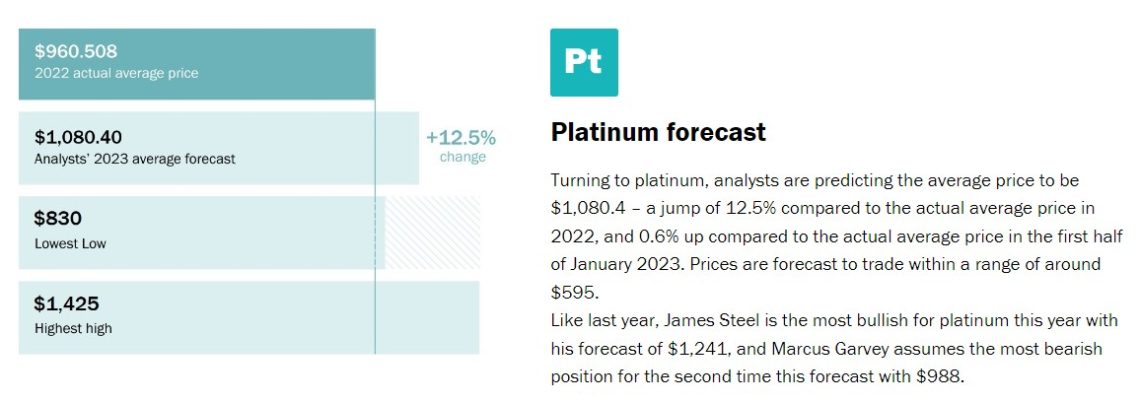

Platinum prices are expected to rise by 12.5% this year – owing to a strong increase in demand across the world. Experts predict that the average price of platinum across this year would be around US$ 1,080 per ounce. Some of the more bullish investors believe that platinum prices might reach as high as US$ 1,241 per ounce this year.

Globally, the demand for platinum is expected to increase by 28% this year and the supply is expected to decrease by 1% compared to last year. Experts forecast a deficit of 983,000 ounces, which is worse than what many people expected last year.

Palladium prices are expected to rise by 3.2% this year as per James Steel of HSBC Securities but not without headwinds as sanctions on Russian sourced Palladium may create a surplus in the market and as the automotive sector begins to substitute the use of palladium with platinum to reduce manufacturing costs, it forecasts a flatter industrial demand outlook.

Factors behind the Demand for Platinum and Palladium

Industrial Demand for Platinum and Palladium

The growing demand for platinum is primarily driven by its industrial applications. Automakers are making more and more hybrid vehicles, which require higher loadings of platinum in their aftertreatment systems. Moreover, many heavy duty vehicle manufacturers are making the switch from palladium to platinum in order to cut costs and save money which is vital during high inflation and a recession.

China has recently tightened its emission control standards for gasoline as well as diesel powered vehicles. In order to meet these standards, vehicles need to have heavier loadings of platinum on autocatalysts.

More importantly, platinum is set to play a vital role in the green energy movement. Owing to its physical and chemical properties, platinum is used as a catalyst in proton exchange membrane (PEM) electrolysis – a technology which is at the forefront of the hydrogen economy.

Platinum’s use in glass and chemical production – particularly in China – is also one of the key factors behind its growing demand.

While palladium has no role to play in the hydrogen economy, its applications in the automotive sector continue to drive its demand steadily.

The investment demand for Palladium saw a decrease of – 109,000 troy ounces in 2022 and with a series of liquidity squeezes between 2019 and 2022, the market conditions are returning to normal. In 2023, the forecast for palladium investment demand is set to increase by 25,000 troy ounces demand and supply of palladium nears balance.

Demand for Platinum Jewelry

In 2022, the demand for platinum jewelry declined by 3% – largely due to the lockdowns in China, which is the largest market for platinum jewelry in the world.

As COVID-related restrictions ease, the demand for platinum jewelry is expected to increase by 15% this year. The demand for platinum jewelry in India, which is one of the fastest growing markets for platinum jewelry, is also expected to remain steady for the remainder of the year. The platinum jewelry market in India has grown by 10 times over the last decade and is showing no signs of slowing down. The demand for platinum jewelry is also expected to increase in Japan, which one of the largest consumers of platinum jewelry on a per-capita basis.

Choose J.Rotbart & Co. for your Platinum and Palladium Investments

Last year, the demand for Platinum and Palladium bars and coins had seen a great rise in interest amongst clients. Although the supply had been restricted heavily, we at J. Rotbart & Co. were able to offer clients a wide range of products like the 1 ozt Platinum Philharmonics coins, 1 ozt Platinum Valcambi bars, 10 ozt Credit Suisse Platinum bars and Platinum good delivery bars to name a few all around the world in an efficient and secure manner.

At J. Rotbart & Co, we have a team of highly qualified professionals who have extensive experience in precious metals management. With our unmatched investing expertise and unique insights, we can help you meet your precious metal investment needs and offer personalized solutions to help you meet your long-term investment goals.

To know more about adding platinum and palladium products to your portfolio, or any other precious metal of your choice, fill out our online contact form and schedule a free consultation with one of our investment experts today!