The Precious Metals Outlook 2023

Published on 21st February 2023

Global markets in 2022 were marked by high volatility for a variety of reasons. Amidst continued economic uncertainty, precious metals have emerged as the clear macro-economic winner and have outperformed traditional asset classes like stocks and bonds by a significant margin.

Despite the aggressive interest rate hikes, a strong US dollar, and record high inflation, gold managed to retain its value, silver was up by 3%, and platinum was up by 11%. While the geopolitical and economic situation has not changed much in 2023, the ongoing market trends indicate that precious metals will continue to perform better than most other asset classes.

Precious Metals are Off to a Solid Start in 2023

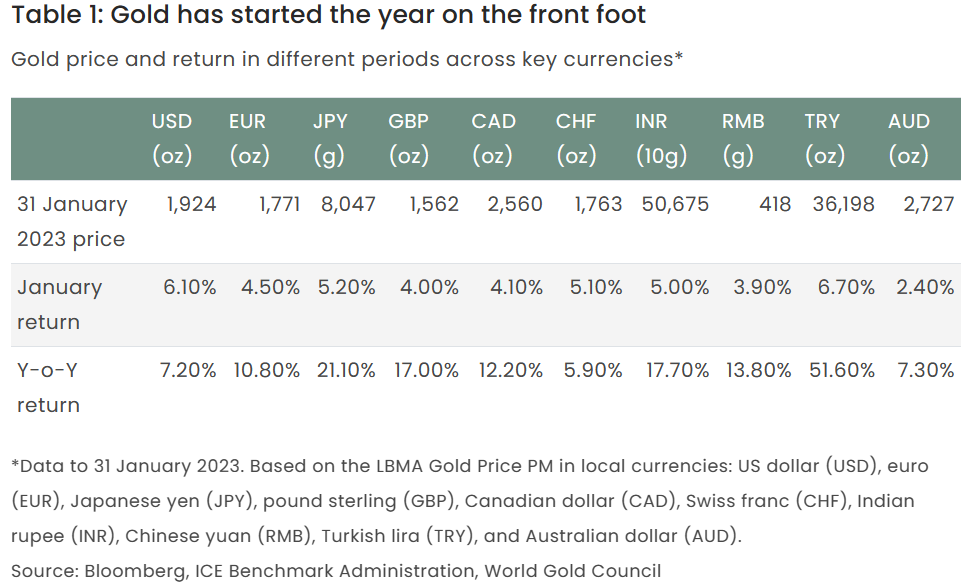

Precious metals in general and gold in particular are off to a good start in 2023. In January, the price of gold increased to US$1,924 per oz – which translated into a +6.1% return against the US Dollar.

Data shows that gold performed equally well against a number of other global currencies as well. It rose 2.4% against the Australian Dollar, 3.9% against the Chinese Yuan, 4% against the British Pound, 4.1% against the Canadian Dollar, 4.5% against the Euro, 5.1% against the Swiss Franc and 5.2% against the Japanese Yen.

Gold’s year-over-year returns against global currencies are even more impressive. It rose 5.9% against the Swiss Franc, 7.2% against the US Dollar, 7.3% against the Australian Dollar, 10.8% against the Euro, 12.2% against the Canadian Dollar, 13.8% against the Chinese Yuan, 17% against the British Pound and 21% against the Japanese Yen.

A number of factors can be attributed to gold’s strong performance so far in 2023. These include:

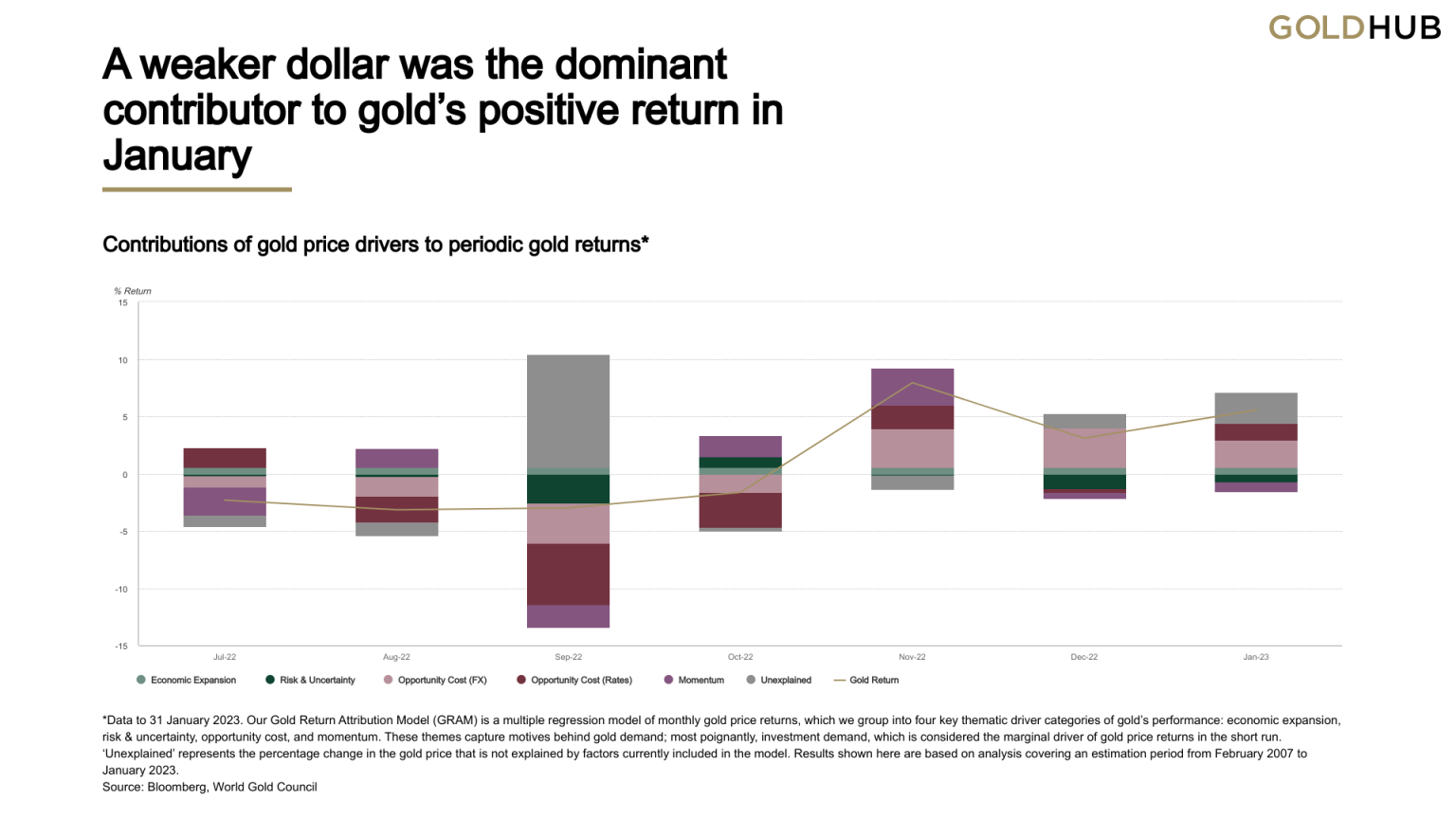

- A weakened US Dollar is one of the most important factors that contributed to the increase in gold prices in 2023. Data shows that between November 2022 and January 2023, there was a 7% decline in the nominal broad dollar index. In addition to that, there was a 37 basis point drop in the 10-year Treasury yield, which also contributed to gold’s strong performance in January.

- Central banks purchased 28 tons of gold in December 2022, which contributed significantly to the increase in demand for gold. The trend is expected to continue in 2023, as central banks around the world are trying to reduce their dependence on the US Dollar by diversifying their foreign exchange holdings.

- There was a notable increase in demand for gold coins and bars in the US in 2022. The overall global demand for gold coins and bars increased 2% in 2022 to 1,217t, thanks to brisk retail investment, which lifted the demand for bars and coins to a 9-year high. Retail investors bought a total of 222,500 troy ounces of Eagle and Buffalo coins last year.

Strong growth was witnessed in Europe, Middle East, Turkey and India. One of the underlying factors was that there was a significant pent-up demand post-Covid. Secondly, many retail investors were willing to repose their trust in precious metals as a safe haven investment in an uncertain economic climate throughout 2022.

Why Precious Metals are Likely to Perform Better Than Stocks, Bonds and Other Asset Classes Throughout 2023?

- The Federal Reserve has become less aggressive with its interest rate hikes, which can cause gold prices to go up. As interest rates stabilize and the US Dollar continues to weaken, gold might perform better than it did in 2022.

- The resurgence in economic activities in China after prolonged COVID-19 lockdowns is also a factor that can lead to an uptick in gold prices in 2023. The demand for gold jewelry also remains consistently high in China and India – the largest and the second largest consumers of gold in the world – despite minor ups and downs in retail demands from time to time.

- Silver is expected to perform better than gold in 2023 due to growing demand and limited supply. The demand for silver is expected to increase considerably in the foreseeable future due to its applications in the automotive, renewable energy, and electronics sectors. Experts believe that silver production cannot keep up with this demand and there could be a deficit of more than 100 million ounces over the next 5 years.

- Platinum is expected to continue its impressive run in 2023 – largely due to the growing demand for automotive platinum and the upsurge in the adoption of hydrogen fuel cells across the world.

- The recent escalation in the Russia – Ukraine war might create instability and uncertainty in the global economy, which in turn can cause investors to gravitate towards precious metals – gold in particular – to preserve their wealth. Moreover, gold has long been considered a safe and effective hedge against inflation. With inflation still at a record high in the US, many retail investors are looking to diversify their portfolio by investing in gold and other precious metals.