The Knights Templar And The Pioneers of Gold-Backed Credit

Published on 7th July 2023

Modern banking has made our lives incredibly convenient and has given easy access to financing to people in the remotest corners of the world. The history of modern banking can be traced back to the 12th century, when a religious order known as the Knights Templar created a system which laid the foundation for the economic world we live in today.

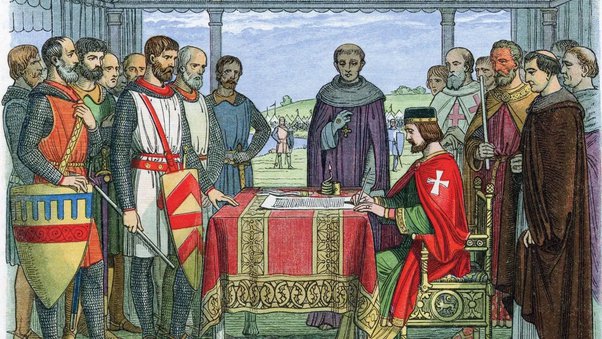

The Knights Templar, originally known as the Poor Fellow-Soldiers of Christ and of the Temple of Solomon, was a Catholic military order founded in the 12th century. Originally founded for the purpose of protecting Christian pilgrims to Jerusalem and safeguarding their possessions, the Knights Templar created a reliable and fraud-proof system that serves as the basis for the banking system that we use today.

The Origin of the Knights Templar

In the 12th century, before the concept of paper money came along, people had to carry gold and silver coins with them, as it was the only form of liquid capital available. The Christian pilgrims who visited Jerusalem were regularly attacked and killed by bandits and highway robbers, as they did not have the means to protect themselves and their possessions.

It was during this time that the Knights Templar was formed to protect the pilgrims and their possessions. The Templars were a group of highly trained fighters who were sworn to poverty. They set up Templar houses in the Holy Land so that pilgrims could deposit their possessions safely.

Each Templar house had a number of strongboxes for the purpose of safekeeping. Once money was deposited, it could only be accessed by the owner or by another party who had the explicit permission of the owner. The Templars were not only incredibly skilled at fighting, but were also heavily armed, as a result of which they could keep robbers and bandits at bay.

More importantly, the Templars did not take or use any of the money deposited in their houses and also did not charge any fee or interest for their services. As a result, Templar houses became the most trustworthy places for people to keep their possessions.

How the Concept of Letter of Credit Came Along

Shortly after their order was founded, the Templars managed to build a large network of houses from the Atlantic to Jordan. Large groups of armed Templars had to move from one place to another constantly to protect pilgrims and to transport their deposits.

In order to avoid carrying large amounts of precious metals and other possessions, the Templars came up with the concept of the letter of credit. A person could deposit their money in a Templar house in their hometown, go to a Templar house in some other town, show the letter of credit, and withdraw the money.

The Knights Templars as Almoners

Over a period of time, the Templars developed a close association with several monarchs. They served as financial managers and treasurers to the Kings of France, England, Scotland, Ireland, and many other kingdoms. In fact, the French treasury was housed in a Templar house in Paris at the time.

Due to their close association with kings, the Templars were entrusted with the responsibility of collecting taxes from the public. When the Saladin Tax was levied in England after the capture of Jerusalem by Saladin, it was the Templars who collected the tax from every household in England.

Apart from collecting money from the public, the Templars also had to play the role of Almoners – people in charge of distributing royal largesse to the public.

Due to their prodigious knowledge, the Templars were also asked to serve as accountants by many kings. Whenever a king or bishop had reason to doubt someone’s accounts, they would ask a Templar to audit the accounts.

The Knights Templars as Financial Fixers

Apart from safekeeping, accounting, and collection and distribution of funds, the Templars also provided a wide range of other financial services.

The Templars brokered financial deals and facilitated the buying and selling of various assets. One of the most notable deals was King Henry III’s purchase of the island of Oleron – which was brokered by the Templars.

The Templars also offered loans and lines of credit to businessmen and townships. Due to their reputation as incorruptible warriors, the Templars were often trusted with prized possessions and rare commodities that no one else could be trusted with. During the height of their powers, the Templars were the most trusted choice of financing and fundraising for businessmen, kings, and church officials across Europe. Such was the level of trust they enjoyed that at one point in the 12th century, the Crown Jewels were kept in a Templar house as collateral for a loan.

Lombard Loans Against Your Gold and Silver Holdings

Precious metals are as valuable now as they were during the times of the Knights Templar. Apart from serving as a hedge against inflation, precious metals can help you build long-term, generational wealth which is vital during times of inflation and high food costs, for instance.

At J. Rotbart & Co, we believe in the power of precious metals. It’s why we offer precious metals collateral loans with highly flexible terms. You can leverage the value of your precious metal holdings and get the money you need, whenever you want.

We offer up to 85% of the value of your total holdings. We require minimal documentation and the terms of repayment are very flexible. You can choose to pay us on a monthly, quarterly, biannual, or annual basis – depending on your convenience.

Contact us online today to find out more about our gold and silver loans.