The Perplexing Year – A review of events in the financial world during 2023

Published on 28th December, 2023

When we reflect upon the events in the financial world during 2023, we realize how strange this year has been. It has managed to surprise and confuse even the most experienced financial analysts. In this article, we will review the trends which have shaped the global economy this year, and try to explain why market participants have found them to be so baffling.

Higher For Longer?

During 2023 we have seen a continuation of the tightening cycle which began in the previous year. Central banks across the world have been attempting to regain control of inflation, by raising interest rates and reducing their balance sheets. This was a major shift in policy compared to the past decade, in which interest rates were close to zero. However, during his latest press conference, Federal Reserve chair Jerome Powell has signaled that the tightening cycle is over, and that the FOMC is discussing the possibility of rate cuts during 2024. According to the Fed Funds futures data, the market is currently expecting no less than three quarter-percent rate cuts during the first half of 2024.

The Missing Recession

The greatest conundrum during 2023 was the absence of a recession. After a deep inversion of the yield curve, which historically has been the most reliable indicator of a coming recession, many in the financial world were expecting to see a recession in the US this year. Based on past experience, they were bearish on the stock market, and positioned themselves in long dated treasuries. However, this recession failed to appear. As a matter of fact, the Q3 GDP figure was remarkably strong, and the US economy grew at an annualized rate of 5.2%.

The most plausible explanation is the large fiscal deficit by the Biden administration, which has reached 6.3% of GDP. The federal government has spent large sums of money on the transition to renewable energy (through the “inflation reduction act”), on student loan forgiveness and on the ongoing conflict in Ukraine. It was also forced to spend more on interest payments on the national debt. The increased spending has encouraged economic activity, and helped the US avert a recession this year. This signals the emerging trend of “fiscal dominance”, in which monetary stimulus is being replaced by fiscal stimulus.

The Recovery In The Stock Market

After a difficult 2022, the stock market has had a remarkable recovery during 2023. Since the beginning of the year, the S&P 500 index has increased by 21%. Just as we’ve seen throughout the past decade, the rally has been led by the large tech stocks, which are now known as “the magnificent seven” – Apple, Microsoft, Google, Amazon, Meta, Tesla and the new member Nvidia. This rally has caught the bears completely by surprise, and demonstrated yet again how treacherous this market can be. Convinced that inflation has been defeated, and that the Federal Reserve has been able to engineer a “soft landing”, stock market investors seem to believe that the worst is behind us, and that the bull market will continue for years to come. However, the indices are yet to set a new all time high, and therefore the current move is still suspect. Technically speaking, the entire 2023 rally could turn out to be nothing more than an exceptionally large bull trap.

Trouble In The Bond Market

As we have warned in our previous articles, a rising interest rate environment is bad for bonds. During the summer of 2023 we have seen a sharp decline in the price of long dated government bonds (which corresponds to a rise in their yields. This happened simultaneously with an increase in the issuance of US government bonds, needed in order to fund the rising deficit.

The benchmark US ten-year treasury yield has broken out of its resistance at 4%, which held since late 2022, and advanced rapidly to 5%. Although bond portfolios are yielding higher returns, this has come at the price of losses to the principal. For instance, the popular BND fund, which invests in a variety of debt instruments, has lost at one point 24% of its value, compared to its 2020 high. This is something which is not supposed to happen to an asset which is regarded as a safe haven, and is widely used in order to mitigate the volatility of the stock market. Since then the bond market has stabilized, and yields have come down. But if this trend continues in the coming years, portfolio managers will need to reconsider their entire strategy.

Crisis In The Banking System

What the Fed has essentially done, was to allow banks to borrow the full face value of their depreciating government bonds, and this way ensure their liquidity until these bonds mature. But the underlying problem in the bond market has not changed, and further declines in the value of government bonds may reignite the crisis, on a much larger scale. Keep in mind that this special lending facility is also increasing the liquidity in the financial system and undermining the Federal Reserve’s efforts to curb inflation. In other words, the Fed can’t have its cake and eat it too.

The Rising Risk Of War

On October 7th 2023, Hamas terrorists have issued a brazen attack against Israeli villages surrounding the Gaza strip. Over 1400 Israelis were brutally killed, including many women and children, and around 240 Israeli civilians were abducted and held as hostages. As a result, Israel has vowed to destroy Hamas, and has launched a widespread campaign against its operatives and infrastructure in the Gaza strip. Mass demonstrations in favor of both Palestinians and Israelis have erupted throughout Europe and the US, exposing the bitter animosity between the left and the right, and between local and immigrant communities. This conflict threatens to escalate into a regional confrontation with Iran and its proxies, such as Hezbollah in Lebanon, The Assad regime in Syria and the Houthi rebels in Yemen. Beyond the obvious human suffering, this war may endanger the flow of oil and other commodities through the Strait of Hormuz and the Gulf of Aden, which are some of the most important waterways in the world. Such a development may trigger a global economic crisis on its own.

Political Turmoil

The next elections in the US will not take place until November of 2024, but unofficially, the race for the presidency has already begun. President Joe Biden’s approval rating has declined to 40%, the lowest level of his presidency, while according to recent polls, Donald Trump has taken the lead in five swing states. If elected, the former president is promising to enact sweeping reforms in Washington D.C. and to purge any government official who opposes his policies. However, there is a chance that Trump will not even be allowed to participate in the next elections, due to a series of criminal indictments against him, which according to his supporters are politically motivated.

There is growing concern that no matter the outcome, by late 2024 the US will be facing widespread protests and unrest. In our view this increases the probability that the Federal Reserve’s tightening cycle is over. It is hard to imagine the central bank continuing to hike rates when the economy is facing such headwinds. In other parts of the world, the outspoken libertarian economist Javier Milei has just been elected as president of Argentina, and in the Netherlands, Geert Wilders’ controversial PVV party has won a majority of seats in the parliament. These upset victories indicate a growing feeling of discontent among the public. In the case of the Netherlands, this may even lead to a further weakening of the European Union, as Wielders is in favor of leaving it.

The End Of An Era

Henry Kissinger, the famous secretary of state under presidents Nixon and Ford, recently passed away at the age of 100. With his realpolitik approach, he was one of the most influential figures in American foreign policy post world war II. Arguably, his greatest accomplishment was the negotiation of the 1974 pact between the United States and Saudi Arabia, which ended the Arab oil embargo, and established the petrodollar system. Since then, international oil trade has been conducted exclusively in dollars, and the earnings have been invested in US treasuries. This has created a constant demand for dollars, which helped support their value, after the Bretton Woods agreement was canceled and the dollar was no longer backed by gold. Nowadays, this system appears to be breaking down. Saudi Arabia and other oil exporting nations started accepting different currencies in exchange for oil, and the value of the dollar is once again at risk. Isn’t it symbolic that the petrodollar is dying, along with the man who first conceived it?

The multipolar world order

In May 2023, King Charles the third was crowned, and officially became king of the United Kingdom and the British commonwealth. We tend to forget that, but the British king is also the monarch of Canada, Australia and New-Zealand. Although the United States has been the leading superpower in the post world war II era, the United Kingdom served an important role in cementing the alliance between the western nations, and the figure which most embodied this alliance was his mother, Queen Elizabeth the II. With her passing, we witness the formation of a new world order, in which there is no single hegemon, but instead there are multiple centers of power. The clearest sign of that is the expansion of the BRICS organization, to which over 40 new countries have applied to join. We can only pray that this process will not unravel the delicate balance between east and west.

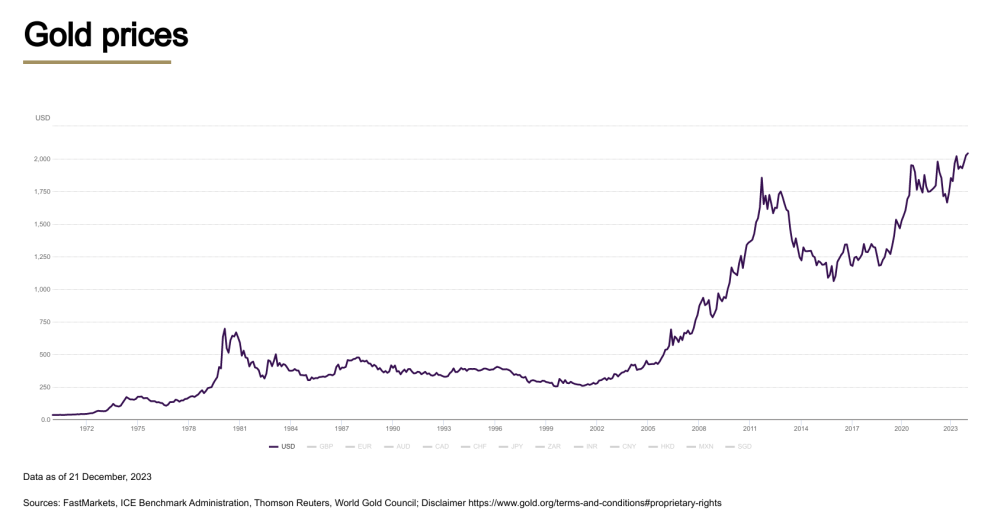

Precious Metals On The Verge Of A Breakout

We are happy to inform our readers, that the precious metals are finally breaking out of their three year long consolidation. On November 2023, Gold had a strong monthly close above 2000 USD an ounce. It later proceeded to set a new all time high of 2146 USD an ounce. Silver had a monthly close above the falling trend line which extends all the way back to its 2011 high, and acted as resistance since then. Now that the metals have cleared these technical hurdles, they appear ready to advance. We realize that for many investors, the performance of gold and silver since the summer of 2020 has been very disappointing. In spite of the inflation and the geopolitical upheaval we have experienced during this period, the price of the precious metals was stagnant. This was mainly due to the Federal Reserve’s tightening campaign, which made the US dollar stronger relative to other currencies, and negatively affected the price of gold and silver in dollar terms. But if we examine the price of gold against other leading currencies, such as the Euro or the British Pound, we will discover that it has been setting new all time highs for quite some time. Now that the tightening cycle is drawing to its end, we believe that gold will set new highs in dollar terms as well. This is the nature of the beast. We cannot anticipate the performance of the precious metals in the short term, but we are confident that in the long term, gold and silver investors will be rewarded for their patience.

The AI Revolution

From a technological point of view, the most exciting development of 2023 was the rapid advancement in the field of artificial intelligence, specifically using what is called “Large Language Models”. These models are able to study large amounts of texts, identify repeating patterns, and simulate human writing in a very convincing way. Similar achievements have been made in the field of image generation. Theoretically, they are now able to replace humans in a variety of jobs, such as reporters, lawyers, accountants, architects and graphic designers. On one hand, this has the potential to reduce employment costs, and make our economy more efficient. But on the other hand, this could increase unemployment dramatically, hurt consumer spending, and exacerbate the already high gap between the rich and the poor. Human beings were never the fastest or the strongest creatures on earth, but we were always the most intelligent. The advent of AI is threatening to take this title away from us. This is why it entails both opportunity and danger. One thing is certain – we are headed towards exciting times.

At J. Rotbart & Co, we go above and beyond what most dealers do in order to provide a secure and satisfactory investment experience for all our clients. Wide selection of high-quality precious metals products, our transparent & competitive pricing and successful track record set us apart from other dealers.

We strive to provide a positive buying and selling experience to all our clients. We are responsive to customer inquiries, address concerns promptly, and offer support throughout the buying and selling process. Contact us today by filling out our inquiry form or email us at [email protected] for all your gold and other precious metal needs.