When Gold Finally Breaks Out

Published on 14th May, 2024

After three and a half years of consolidation, the price of gold has finally broken out. During April, it set a new all time high of 2,430 USD per ounce. This move has caught many in the financial world by surprise. They have wrongly assumed that inflation has been defeated, or that Bitcoin has taken over the role of gold as a safe haven asset. As we will demonstrate in this article, that is far from true. Gold is a powerful component of the global economy, and those who attempt to write it off are doing so at their own peril. As a matter of fact, there is currently a confluence of factors, which are favorable for the price of gold. And even though it may experience sharp corrections, we believe that they will continue to drive its price forward in the coming months and years.

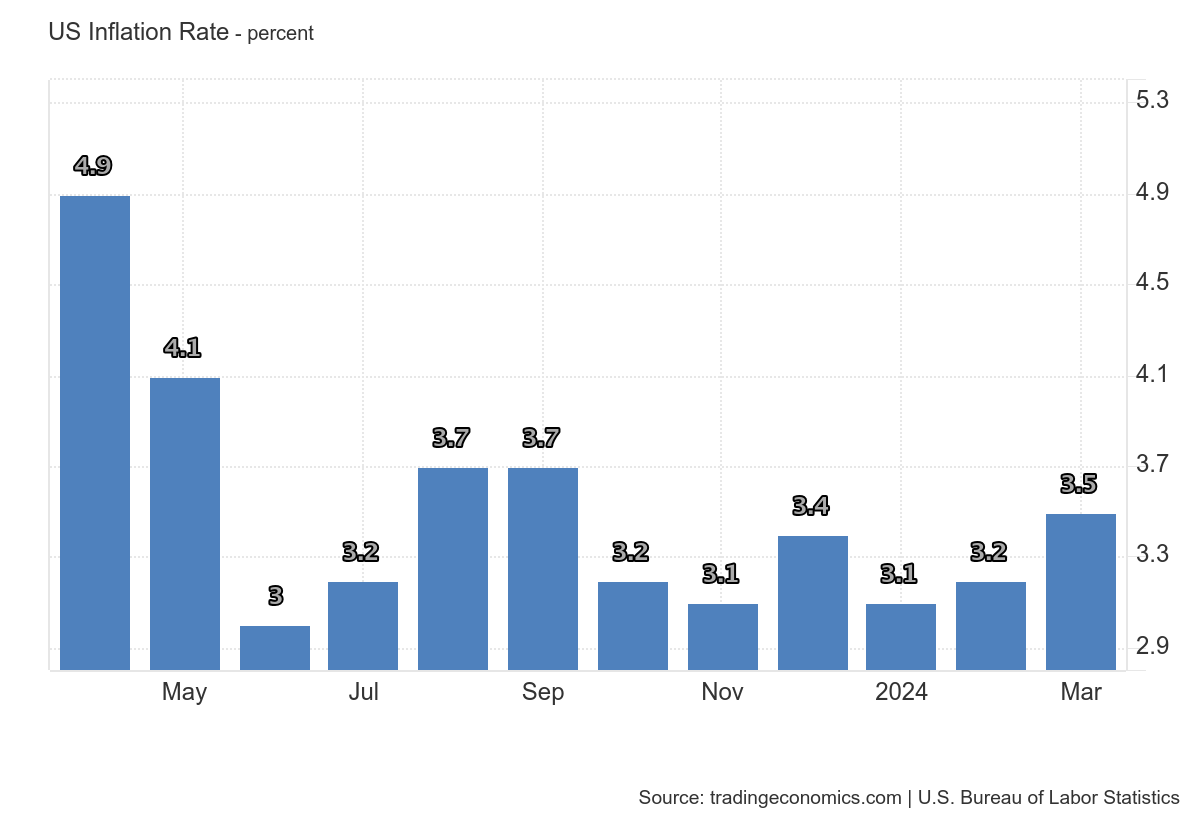

The resurgence of Inflation

As the saying goes, once the inflation genie is out of the bottle, it is very difficult to put it back in. Although the annual rate of inflation in the US has fallen considerably, from a shocking 9.1% in June 2022 to a more palatable 3.1% in January 2024, it is still higher than the Federal Reserve’s target of 2 to 3%. In fact, in March it ticked up to 3.5%, raising concerns that another wave of inflation is right around the corner. Other measures of inflation such as the core CPI or the PCE have remained stubbornly high as well. As a traditional hedge against inflation, gold must be reacting to this data. Indeed, the price of gold does not continuously track the rate of inflation. History shows that there could be a lag between the two. But once in a while, the price of gold “wakes up”, sort of speak, and does the accounting of all the inflation which previously took place. The timing of such events is extremely difficult to predict, because it depends on crowd psychology. Therefore we advise our customers to keep a constant exposure to precious metals, and not to attempt to time the market.

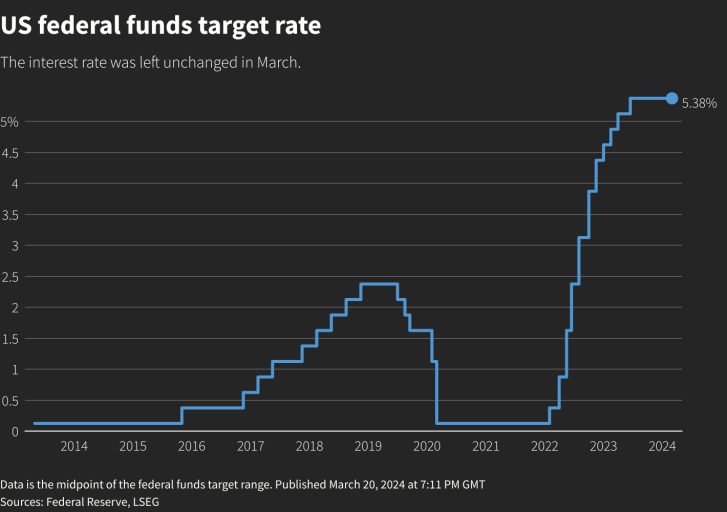

Federal Reserve policy

As you may recall, just a few months ago Fed Chair Jerome Powell has signaled that the tightening cycle is over, and the consensus on Wall Street was that the central bank would cut its benchmark rate three times in 2024. In light of the recent uptick in the rate of inflation these expectations have largely been dialed down. Current futures pricing data implies that the Fed funds rate will remain constant until the end of the year, and that all rate cuts have been postponed to 2025. However, this is still considered to be a dovish policy. Normally, this hotter than expected inflation data would prompt the Federal Reserve to continue with its tightening campaign. But apparently, Jerome Powell is reluctant to hike rates during an election year, and this is very bullish for gold. If the central bank is willing to throw caution to the wind, and risk another wave of inflation due to political reasons, then the public has no alternative but to protect the value of their savings with gold.

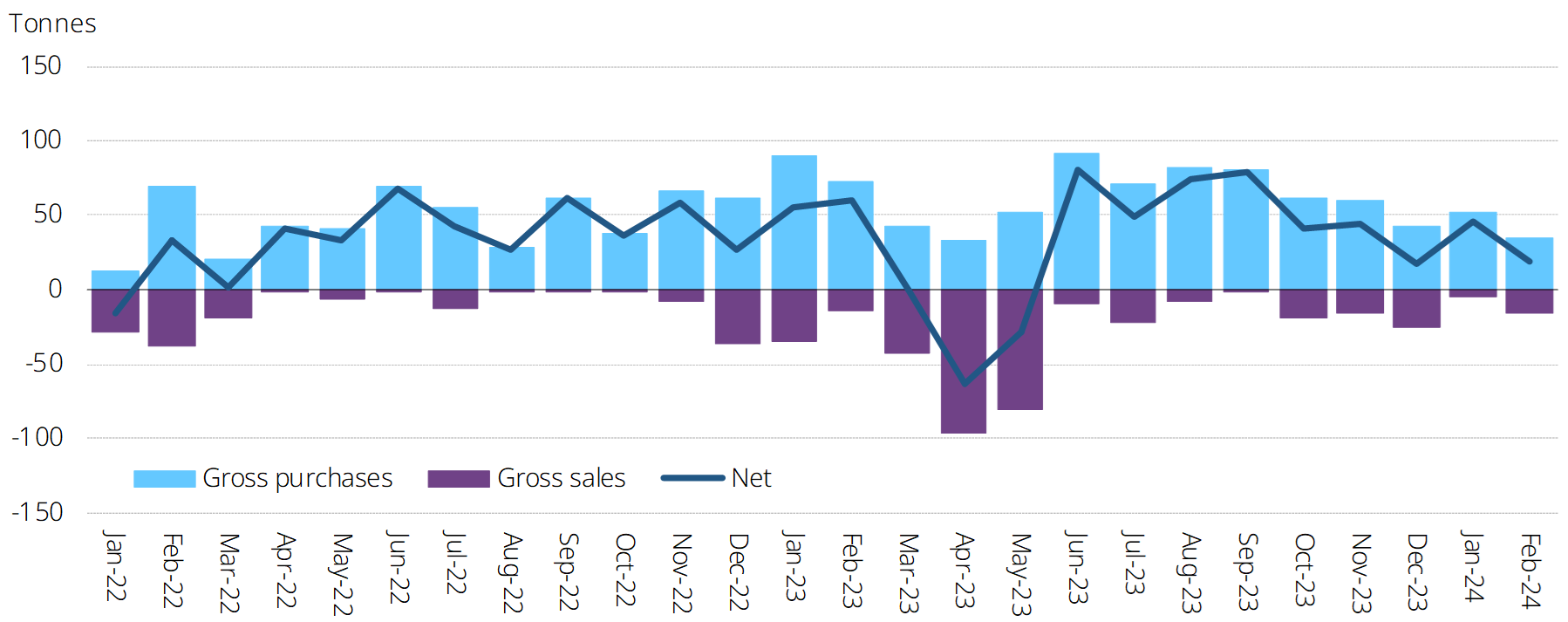

Central bank purchases

In the past two years, key players in the gold market have been central banks from across the world, who wish to expand their exposure to the precious metal. According to the world gold council, in the first quarter of 2024 central banks added 290 metric tons of gold, the strongest start to a year on record. Among them we can count the central banks of China, India, Turkey and Kazakhstan. This trend was probably influenced by the sanctions which the US has imposed on the Russian Federation since 2022, following the invasion of Ukraine. The US has frozen Russian assets worth nearly 300 Billion USD, and recently decided to seize them. It has also banned Russian banks from participating in the SWIFT system, limiting their ability to conduct international trade. This has signaled other central banks, particularly in emerging markets, that in order to maintain their independence, they require more gold. As the only reserve asset which is not the liability of any other party, gold grants central banks a high degree of security and flexibility. In a climate of growing suspicion and mistrust between nations, we can only expect this trend to continue. Furthermore, discussions are taking place among members of the BRICS organization, regarding the launch of a new trade currency, which will reduce their dependence on the US dollar. There are speculations that such a currency will be backed by a basket of commodities, including gold. This may explain the increased demand for the precious metal among central banks.

Rising risk of a financial crisis

There are multiple indicators that the world is facing yet another financial crisis. Just a year ago, we have witnessed the collapse of several mid-sized banks in the US, including SVB bank, Signature bank and First Republic bank. These banks became insolvent due to the decline in the market value of their bond portfolios, which in turn was caused by the rising interest rates environment. Clients became aware that the liabilities of these banks exceed their assets, and started withdrawing their deposits. As a result, the banks were forced to liquidate those bonds and realize the losses. This triggered a series of bank runs and put the entire financial system in danger of contagion. Finally, the Federal Reserve stepped in and established a special lending facility called the “bank term funding program”, or BTFD. Although the main cause for this banking crisis, namely the rising interest rate environment, has not changed, the Federal Reserve ended this program in March. No wonder then that yet another bank, called Republic First (no connection to First Republic bank) just collapsed, and was seized by the regulator. In the absence of support from the central bank, there is every reason to believe that this crisis will resume.

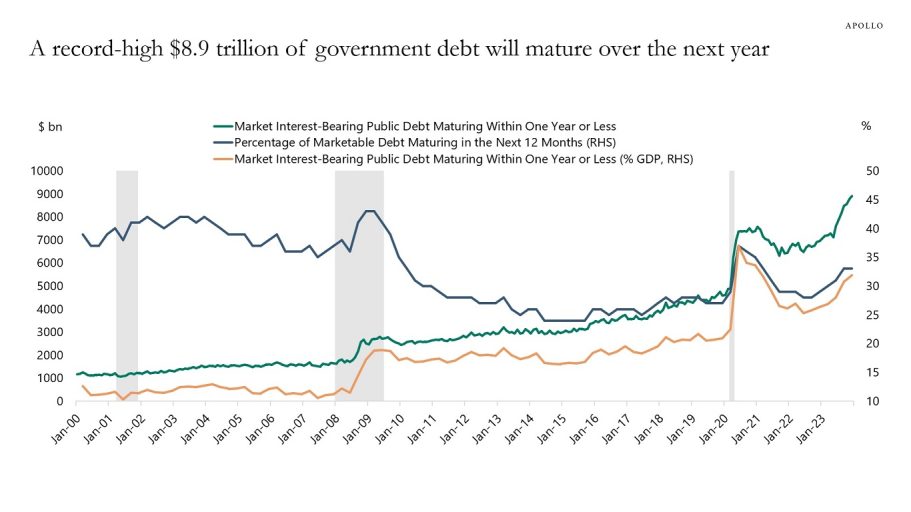

Another risk which has recently surfaced is emanating from the other side of the pacific ocean. The rapid depreciation of the Japanese Yen is threatening to put an end to one of Wall Street’s favorite trades. As you may know, interest rates in Japan have been kept extremely low for many years. This has prompted traders to loan money in Japan, use it to purchase US treasuries, and pocket the difference between interest rates. It is known as the Yen carry trade, and until recently it offered an almost risk free return. Due to the high government debt to GDP level the Bank of Japan was reluctant to raise rates, even after 2020, when inflation started to pick up. As a result, the Yen started losing value. For Wall Street traders this was actually good. The dollars they were earning in the US were buying more and more Yen, and it was easier for them to repay the loans. But what if the bank of Japan panics and decides to raise rates and fight inflation after all? All of a sudden, those traders may be forced to unwind their trades, sell their treasuries and use the proceeds to purchase Yen. This could spike the Yen, tank the dollar and send bond yields way up. Mind you, this is happening while the US treasury needs to refinance 8.9 Trillion USD worth of debt by the end of the year, and the amount of willing buyers is waning by the day. This is a recipe for disaster, and unfortunately, very few people on Wall Street are giving it any thought.

And while we’re on the topic of US treasuries, it is worth noting that the yield curve has inverted in October 2022. Historically, this has been the most reliable indicator of a looming recession within 12 to 18 months. Since so much time has passed since then people have lost faith that a recession is indeed coming. But we are now exactly 18 months into this inversion, and if a recession begins shortly it will fall in line with previous instances. If we do see another financial crisis in the US, accompanied by a stock market crash, the Federal Reserve will probably slash interest rates back to zero and launch another QE program, inflation be damned. In that case, the price of precious metals is likely to fall together with the stock market, due to a decline in industrial demand. But it tends to recover quickly once central bank policy becomes easy again, due to increased monetary demand. It is very difficult to withstand this kind of volatility, but gold and silver investors should hold on to their positions, because history shows that it is the best course of action.

The risk of war

Gold is not only a good hedge against a financial crisis, but also against a military conflict. Just as we have warned in our previous issues, the current conflict in the middle east is threatening to escalate into a regional confrontation. On April 13th, Iran has launched a barrage of drones and missiles against Israel, after an air strike in Damascus claimed the lives of several high ranking Iranian officers. Thankfully, Israel has been able to intercept most of these missiles and the damage from this attack was minimal. This has allowed both sides to deescalate the situation, but the gravity of the event should not be underestimated. Until today, Iran has always faught Israel through its proxies – Hamas in Gaza, Hizbullah in Lebanon and the Houthi rebels in Yemen. It is the first time in which Iran attacks Israel openly and directly, and this does not bode well for the region. Iran is threatening to close the straight of Hormuz, and its allies in Yemen are disrupting the passage of ships through the gulf of Aden. These are two of the most important waterways in the world, and their closure could send the price of commodities sky high and lead to another wave of inflation. Gold is the only practical way in which the average person can get an exposure to the commodity sector, and protect himself against such an unfortunate outcome. We are all praying for peace, but at the same time we should hedge our portfolios against the possibility of war.

Because it’s cheap!

The most trivial factor which is driving the price of gold higher is the fact that it is relatively cheap. After three and a half years of consolidation between 1,800 and 2,000 USD, gold has established what technical analysts would call “a strong base”. Compared to other asset classes such as stocks or cryptocurrencies, it is not overly extended, and it is well positioned to advance further. Investors who have an allocation to gold as part of a balanced portfolio should be taking advantage of the recent all time highs both in the Nasdaq and in Bitcoin in order to reduce risk and lock in those gains. Indeed, watching gold move sideways for an extended period of time was difficult, to say the least. But now we can finally reap the rewards, as gold once again becomes the most attractive asset to own.

Investing in precious metals is a time-tested way to protect your portfolio against known and unknown market risks and preserve your wealth. Whether you are looking to invest in gold, silver, platinum, or palladium, the precious metals experts at J. Rotbart & Co can help you.

With decades of experience in precious metals trading, logistics, and management, we are equipped to handle all your precious metal needs. We offer the highest quality precious metals at competitive prices. We also offer a wide range of other services including authentication and assaying of precious metals, storage, lending and finance, and investment advice.

Whether you are a beginner investor looking to build a portfolio or an experienced investor looking to diversity your portfolio, we can help you invest in the right precious metals.

Get in touch with us today using our online contact form to schedule a free consultation with one of our precious metals experts.