China’s Romance with Gold and why Everyone is Looking to Buy Gold

People around the world look to buy gold

Gold’s surge in popularity, which began after the 2008 global financial crisis, continues as central banks are seen making some of the highest gold purchases in the first half of 2019 since 1971 (the 1st year data was collected on global central bank purchases). The World Gold Council’s mid-year central bank survey, published on 18 July 2019, reported that one fifth of central banks surveyed intended to increase their gold holdings over the next 12 months, with none planning a decrease.

Over 20 central banks bought gold in the last year with 224.4t purchased in 2019Q2, bringing the total for the first half of 2019 to 369.9t. Buyers were diverse, many from largely emerging economies, as well as some new to gold and some that had been dormant in the gold market for several years. This growing demand to buy gold as a reserve asset was significantly increased as a response to the current global political and worldwide economic climates.

China continues to be a major player in the global gold market

China continues to be a major player in the global gold market

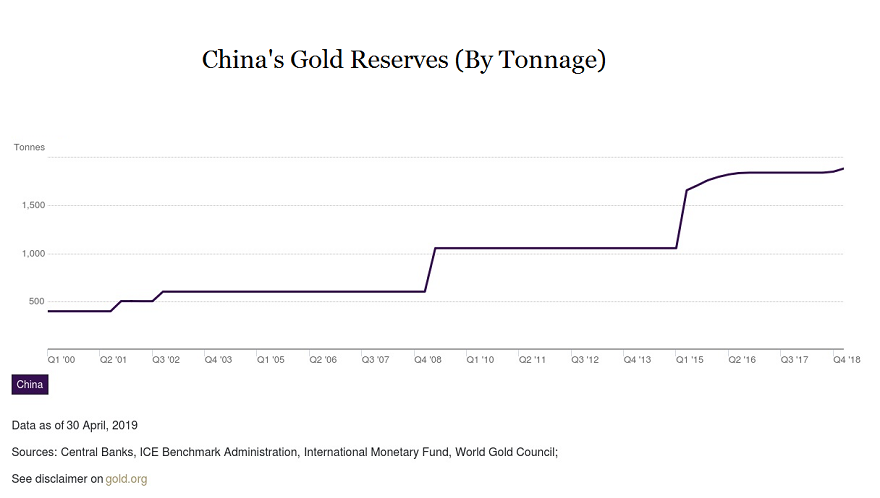

Although the WGC’s report describes diverse buyers, particularly from emerging markets, China has been and continues to be a major buyer in the global gold market. This has been difficult to gauge in the past, as evidenced when China’s mid-2015 update announcing its central bank’s gold reserves jumped 57% to 53.3 million ounces was the first since 2009. Nevertheless, along with Russia, China is among the biggest purchasers (and producers) of gold in the world.

Currently, this Asian economic power is on an extended buying spree. As of June 2019, China has added to its gold reserves 7 months in a row, as the People’s Bank of China announced in July 2019 an additional 10.3t to its gold reserves, following a 74t inflow since December 2018.

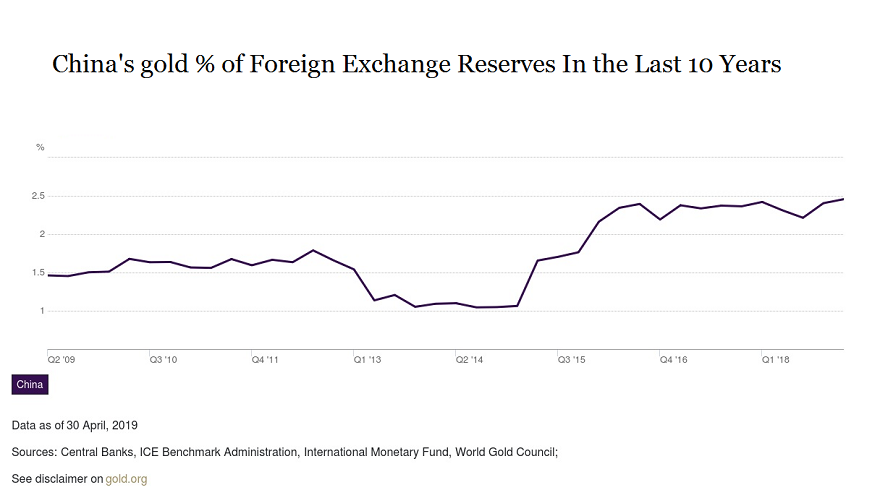

This could be seen as a portfolio diversification as the drawn out US-China trade war could hurt expected growth. Even with this increase, China still holds more fiat currencies in reserve, as is the case in most countries. Compared to the US, which holds 74.5% of its FX reserves in gold (as of June 2019), China only holds 2.8% in gold.

Domestic gold prices are increasing in China

Along with aggressive government activity, speculative trading on the Shanghai Gold Exchange has also seen a spike. According to the WGC report, trading volumes in June 2019 in margin-traded gold contracts reached 2,062t, which is the second-highest level on record. However, 2019Q2 bar and coin demand in China dropped to 49.5t, the lowest since 2016Q3, as overall investor worries about currencies faded.

Gold prices rallied because these currency concerns that previously bolstered gold purchases eased in May 2019 when the People’s Bank of China promised a stable exchange rate. Then, in June 2019, local prices rose dramatically to a six-and-a-half-year high of 322 yuan/g. Disappointed by their losses from the 2013 rush to buy gold, Chinese investors seemed to be holding back, waiting for more attractive and stable pricing. This caused less purchasing and greater selling activity.

China still has productive domestic gold mining

Even as China accumulates gold for its reserves, domestic production has been growing at an impressive rate. The China National Gold Group (CNGG), the country’s major gold producer, recorded solid gold production and sales growth in the first half of 2019, with 47.6 billion yuan ($7 billion) in revenue.

China’s international gold mining expands

China’s appetite for gold mining extends beyond its borders, as can be seen with its recent activity in Africa, particularly Tanzania. As Africa’s fourth-largest gold producer, the Tanzanian government has been seeking to generate more revenue from its mining sector, which includes encouraging foreign investment, such as from China.

According to a Reuters article from 25 July 2019, Minister for Minerals Doto Biteko reported that 37 Chinese companies expressed interest after the government invited bids for building smelters and refineries. “After carefully assessing the financial capability and history of those companies, we have issued licenses for the construction of two gold refineries and a smelter,” Biteko said. These went to Chinese firms.

Why is China purchasing and accumulating gold?

China most likely wants to detach itself from the US dollar as a response to the US government weaponizing the currency through USD-based sanctions and tariffs. As bond yields decrease and the US reconsider the strong position of its dollar, China’s central bank looks to the safe haven of gold, potentially as a harbinger of a currency war. The continuing trade war between China and the US along with other global geopolitical tensions have shook markets and economies around the world. Many, including China, are responding by buying gold for diversification.

As quoted by Bloomberg on 10 June 2019, Bart Melek, global head of commodity strategy at TD Securities, said, “It’s a diversification away from the U.S. dollar, particularly given the trade tensions and the potential technology cold war that’s evolving. We have to remember that gold is nobody’s liability.” China’s central bank holds gold in its reserves to help keep the economy liquid and to back the currency it prints, especially as it tries to reduce its exposure to the US dollar and euro.

As a way to be less dependent on the US dollar while raising funds to buy gold, China has been selling US Treasuries, dropping its holdings from a $US1.32 trillion high in 2013 to about $US1.1 trillion in July 2019. China now owns about half of the approximately 14% of US public debt issued it had owned in 2011.

What does the future hold for China and for gold?

From Brexit to US-Iran tensions to its own escalating trade war with the US to any number of other conflicts causing geopolitical instability, China will probably continue to join financial and economic markets around the world rely upon and look to buy gold for the foreseeable future. As such, gold prices continue to increase. As of 7 August 2019, gold appreciated by 15.73% for the year and by 22.8% from the same date the prior year. So, a safe assumption would be, given the current political, economic, and financial climate, gold will continue its rise.

Buy Gold with J. Rotbart & Co.

Why Us

J. Rotbart & Co. is a boutique firm specializing in physical precious metals and other tangible assets.