Dynamics of Gold: Inflation, Central Bank Strategies, Technology, and Ethics

Published on 11th November, 2024

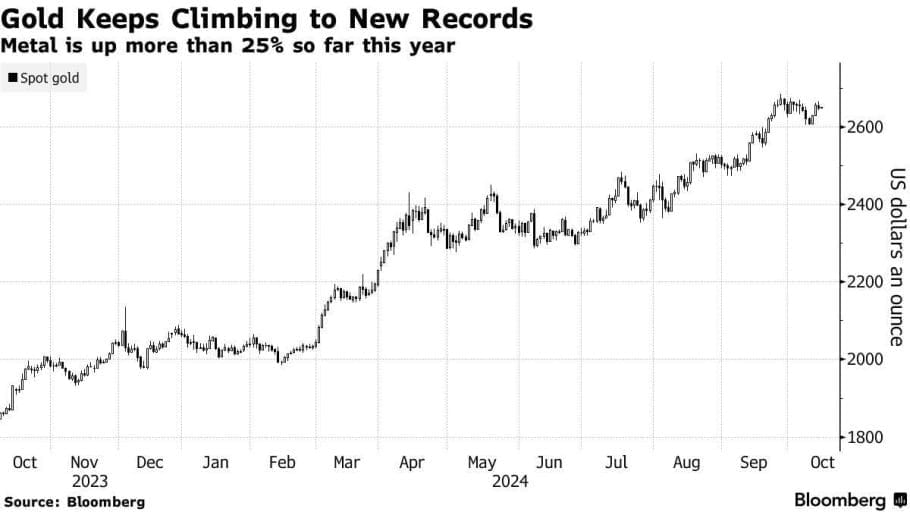

Gold has long held a unique position in global finance and industry. It’s a safe haven during economic turbulence, a benchmark for wealth, and a timeless commodity shaped by technology and ethical considerations. As of 2024, this dynamic interplay of factors — inflation, central bank policies, technological advancements, and ethical standards — is determining gold’s resurgence as a strategic asset class in the global economy.

Impact of Inflation on Gold Prices

How Inflation Drives Investor Behavior

Inflation has a profound effect on gold prices due to the metal’s perceived role as a hedge against currency devaluation. As inflation rises, purchasing power declines, and investors often turn to gold as a safe store of value. Historical trends reveal that gold prices typically correlate positively with inflation rates, albeit with variations based on macroeconomic conditions and monetary policy adjustments.

In 2022 and 2023, surges in US inflation saw gold prices spike as investors sought refuge in the metal. The Consumer Price Index (CPI) registered inflation highs of over 9% in June 2022, encouraging gold’s appeal. Now, with inflation rates stabilizing in 2024 yet remaining above historical averages, gold remains an attractive option for those anticipating further currency devaluation or potential recessionary effects.

US Inflation As a Good Market Predictor

Inflation trends in the US, as the world’s largest economy, influence the global gold market. The Federal Reserve’s decisions on interest rates impact gold prices; when the Fed raises rates to combat inflation, gold prices often face downward pressure as higher yields on fixed-income securities draw some investors away from non-yielding gold.

In recent cycles, however, gold has retained its attractiveness because of its intrinsic value and perceived immunity to inflationary pressures. Investors now consider US inflation data a leading indicator for gold performance, scrutinizing CPI, core inflation, and producer price index (PPI) data to gauge market shifts.

Central Banks Increasing Gold Reserves

Central Banks in Emerging Markets Boost Gold Reserves

Emerging markets have been accumulating gold at a record pace, a trend that began in earnest in the early 2020s. Central banks in countries like China, Russia, and Turkey have increased their gold reserves as a hedge against the US dollar’s volatility, especially in the context of geopolitical tensions and sanctions. This pivot away from dollar-centric reserves has set gold as a strategic reserve asset.

For emerging economies, gold offers insulation from global economic instability and currency devaluation. In 2023, central banks collectively acquired over 1,100 tons of gold, marking one of the highest accumulations in recent history. Such moves are not only defensive but also strategic, positioning these nations to reduce dependency on foreign currencies, particularly the US dollar, amid rising economic nationalism.

Hedging Against Economic Instability and Inflation

For central banks, particularly those in inflation-prone economies, gold represents an inflation-resistant asset and a counterweight to fiat currency reserves. The increase in reserve allocations toward gold reflects growing skepticism toward fiat currencies and a desire for a stable asset that can withstand market shocks. In the current economic climate, where emerging markets confront high inflation, volatile currencies, and geopolitical uncertainty, gold’s role in stabilizing national reserves has grown significantly.

Geopolitical Factors and the Demand for Gold

In 2024, geopolitical uncertainties continue to be a key driver of gold demand, as political tensions and economic policies significantly impact investor behavior and central bank strategies worldwide. The shifting dynamics in global trade, regional conflicts, and sanctions have heightened demand for gold as a safe haven, especially in regions experiencing high political risk.

Impact of Geopolitical Tensions on Gold Prices

Escalating conflicts in Eastern Europe and the Middle East, along with US-China trade frictions, are adding volatility to global markets and reinforcing gold’s role as a crisis asset. During periods of intensified geopolitical risk, investors flock to gold, driving prices upward as they seek refuge from volatile equity markets and currency depreciation. This trend has been particularly pronounced in the last two years, as central banks in affected regions have significantly bolstered their gold reserves to shield their economies from currency risks associated with sanctions and fluctuating trade policies.

Sanctions and the De-dollarization Movement

An emerging trend influencing gold demand is the move toward de-dollarization among countries affected by US-led sanctions, such as Russia and Iran. These nations are shifting reserves from US dollars to gold to reduce dependence on dollar-denominated assets, making gold a central part of their financial defense strategies. Central banks in these regions are increasingly using gold to facilitate international trade and stabilize their economies, driving a substantial rise in global gold demand.

Gold as a Tool for Economic Resilience

In addition to mitigating risks from sanctions, gold is also viewed as a tool for economic resilience amid weakening global alliances. A number of countries, particularly in the BRICS bloc (Brazil, Russia, India, China, and South Africa), have been accumulating gold to diversify reserves, reduce dollar exposure, and foster trade in alternative currencies. This strategy not only shields their economies from geopolitical tensions but also serves as a hedge against economic shocks, further solidifying gold’s role in a diversifying global reserve system.

Technological Advancements in Gold Mining

Automation and AI Enhancing Mining Efficiency

The gold mining industry is undergoing a technological transformation, driven by automation, AI, and machine learning. Automation is increasingly applied in excavation, drilling, and sorting, reducing human error and increasing productivity. Artificial intelligence algorithms now analyze data from mines, improving decision-making on-site and optimizing resource allocation.

Major mining companies are investing in autonomous machinery and AI to reduce operational costs, labor risks, and environmental impact. Automated trucks and drills are reducing human presence in hazardous environments, minimizing accidents and increasing productivity. These advancements also allow for greater precision in locating gold deposits, thereby reducing unnecessary excavation and preserving surrounding ecosystems.

Potential for Reduce Environment Impact

Traditional mining techniques have historically resulted in significant environmental degradation. With new technologies, however, the industry is pivoting towards more sustainable methods. For instance, AI-driven predictive analysis allows companies to identify precise mineral-rich areas, limiting the need for widespread digging and deforestation. Hydrometallurgical processes, which utilize less toxic chemicals compared to traditional methods, are also being employed to reduce harmful tailings.

Renewable energy sources are increasingly powering mining operations, and some companies are exploring the use of carbon capture technologies to offset emissions. By combining automation with sustainable practices, the gold mining industry has the potential to minimize its environmental footprint substantially, aligning with global sustainability goals and addressing public concerns over environmental stewardship.

Environmental and Ethical Considerations

The Rise of Sustainable and Ethical Mining

In response to growing scrutiny from regulators and investors, gold mining companies are prioritizing Environmental, Social, and Governance (ESG) standards. The demand for responsibly sourced gold has surged, especially from institutional investors and consumers who expect accountability in environmental and social practices. This shift has led companies to adopt stricter measures in waste management, land rehabilitation, and water conservation, aiming to mitigate the impact of mining activities.

Large mining corporations are committing to internationally recognized standards, such as those outlined by the World Gold Council’s Responsible Gold Mining Principles. Compliance with these standards not only helps mitigate reputational risks but also attracts capital from ESG-focused investors. This shift toward ethical mining addresses critical issues such as child labor, fair wages, and community rights, transforming the industry to better align with global social expectations.

Adapting to Regulatory Scrutiny and Consumer Expectations

National and international regulations now demand greater transparency in gold sourcing, especially concerning the impacts on indigenous lands and ecosystems. With the rise of “green gold” initiatives, companies are encouraged to trace gold’s journey from mine to market, ensuring ethical practices at each stage. For instance, blockchain technology is being employed to provide a transparent supply chain that assures end-users of gold's ethical origins.

Consumers, too, are increasingly prioritizing ethically sourced gold for jewelry and investments, driven by heightened awareness of environmental and social justice issues. Companies that fail to meet ESG criteria risk losing market share to those that demonstrate a commitment to ethical practices. This trend underscores the growing influence of consumer values on the gold industry and the necessity for ongoing corporate accountability.

Choose J. Rotbart & Co for Your Precious Metal Investment

The convergence of multiple global factors points to a future where gold remains not only a valuable investment, but also a symbol of responsible stewardship and innovation. As economies and technologies evolve, gold’s resilience and adaptability continue to solidify its position as a critical asset within the global financial landscape.

If you are interested in adding precious metals to your portfolio or expanding your current holdings, J. Rotbart & Co offers a comprehensive selection of gold, silver, platinum, and palladium bars and coins. With our industry-leading quality standards and wide range of products, you will have options to find the precious metal that best aligns with your investment goals.

We also provide expert guidance on precious metals investments, lending and financing, secure storage, shipping, and more. Whatever your precious metals needs, we have solutions designed to support you. Reach out to us today through our online contact form or write to us at [email protected] to explore your opportunities in precious metals investments.

Get in touch with us today using our online contact form to schedule a free consultation with one of our precious metals experts.