Unique Alternative Investments: Physical Gold, Bitcoin and NFTs – the Old, the New, and Beyond

Unique Alternative Investments: Physical Gold, Bitcoin and NFTs – the Old, the New, and Beyond

The German Chamber of Commerce in the Philippines held a webinar on 13 July 2021 wherein guest speakers Joshua Rotbart and Nichel Gaba (Founder/CEO of Philippine Digital Asset Exchange) shared their thoughts on gold and Bitcoin, cryptocurrencies, and non-fungible tokens (NFTs). Joshua highlighted the strengths of physical gold as an investment, while briefly discussing the value of Bitcoin and its place in investment portfolios. The webinar discusses the similarities and differences between gold and Bitcoin and whether they are a worthwhile hedge. Later, Nichel Gaba provided further insights into the world of cryptocurrencies, discussing NFTs and the rise of decentralized finance (DeFi)

Gold vs. Bitcoin — A Hot Topic in a Volatile Climate

Joshua Rotbart’s company — J. Rotbart & Co. — provides services covering a wide range of precious metals, including gold, silver, platinum, and palladium, while now also including cryptocurrency services and the ability to trade cryptocurrencies to gold and vice versa. In this webinar, the focus was on gold as an asset class and its relation to Bitcoin. The webinar addresses the “trillion-dollar question” of whether Bitcoin is going to replace gold as a reserve and safe haven asset and hedge against traditional markets.

The likelihood is that gold is going to be around for a while. Over time, it has proven to be a strong hedge, providing returns and security during periods of financial crises and market turmoil, while maintaining its value in the interim. The argument that Bitcoin could replace Gold at some stage isn’t something Joshua believes can happen. Rather he believes this is “wishful thinking” based around the current “hype of cryptocurrencies and Bitcoin”.

To start the debate, Joshua pin-pointed the key similarities and differences between the two:

What Are the Similarities Between Gold and Bitcoin?

“Of course there are a lot of similarities,” said Joshua, which he further elaborated on as: Both are globally accepted, decentralized currencies that are not issued by any specific body. Both can be held privately — Bitcoin in a wallet, and gold in a private vault or even at your home. Both serve well to diversify investment portfolios.

What About the Differences?

“But of course, these two assets are very, very different,” said Joshua, with the main differences as follows:

Gold has a reverse correlation to the stock market while cryptocurrencies are still too new to measure. While Bitcoin is tradable via online exchanges to fiat or other cryptocurrencies, investors face many issues when trying to withdraw funds to their bank accounts. Gold, on the other hand, is very liquid. It is very easy to sell, and allows you to reap your profits without difficulties.

Gold is far less volatile — Gold’s average daily volatility is roughly 0.5% while Bitcoin is roughly 3.5% (7 x times more volatile than gold). Gold has intrinsic value, Bitcoin doesn’t. Bitcoin is not backed by anything. Gold is a tangible asset.

With Bitcoin being digital, it has to be held digitally in a wallet or exchange, exposing investors to cybersecurity risks such as hacks and access difficulties, due to forgotten or lost passcodes.

Finally – Gold has a reverse correlation to the stock market, while the correlation between cryptocurrencies and stocks are still unclear. Cryptocurrencies haven’t been around long enough to provide a meaningful dataset.

Should Your Portfolio Include Gold, Bitcoin, or Both?

“A short disclaimer,” said Joshua, “we are a gold company, a precious metal company. We are not investment advisors…whatever you see here is our opinion based on our experience.”

So where are gold and Bitcoin? How should they be included in your portfolio?

“This all relates to risk, and where you are putting yourself in terms of your risk portfolio,” said Joshua. If gold is considered less risky and ‘safer’, should you stick with that? Or would a higher risk, more volatile asset such as Bitcoin be more worthwhile? Of course you could also invest in both gold and Bitcoin and have a position “on opposite sides of the risk horizon.

With Bitcoin, you are of course in a higher risk position than with gold. It usually has a lower correlation to the financial markets and it’s more about capital appreciation over safety, i.e. “high risk, high reward” as Joshua comments. In this regard, we can consider Bitcoin a valid option. The key here is to enter these markets with the mindset of hoping for the best, but being ready for the worst.

Gold is on the opposite side of the risk spectrum. “Gold mitigates risk and is proven to perform well in times of crisis,” said Joshua. It’s very liquid, easy to buy and sell, “and it reduces volatility in your portfolio.”

Take the Philippine peso as an example. “Gold is a great protection against depreciation as gold is denominated in US dollar. It exposes you to the dollar, but appreciates its value,” said Joshua. “When there is a crisis, gold is the go-to asset, and that is not something we can say about Bitcoin.”

Introducing JR Crypto

“Our new sister company, JR Crypto, now provides similar services to J. Rotbart & Co, but with a crypto angle,” said Joshua. The main idea is that crypto investors who make profit can invest some of this profit into less volatile assets, like gold. Transactions can be run both ways: using crypto to buy gold, and vice versa. If you have a ledger for your crypto holdings, JR Crypto can keep it safe for you in a secure vault at one of our global locations (i.e. cold storage).

In summary, gold and Bitcoin are complementary assets. There is room for Bitcoin as an investment, but it should be at the riskier end of your portfolio. Since gold is the safer bet, it should normally account for a larger portion of your portfolio than crypto. For example, “if gold is 10% of your portfolio, crypto could be 1% or 2%, depending on your risk appetite,” explains Joshua.

Is Bitcoin Digital Gold? A Few Words by Nichel Gaba

Our second speaker was Nichel Gaba, Founder/CEO of Philippine Digital Asset Exchange, who covered gold vs. Bitcoin, Ethereum, decentralized finance, and NFTs.

“Gold today, plays a very important role in the financial markets…gold is what we use to suck out liquidity in the financial system….that role can be played, to some extent by Bitcoin,” explains Nichel. Financial institutes will likely hold physical gold for the foreseeable future. But for example, in the Philippines, there isn’t a local physical market for gold; the market exists “in the collateralized lending market such as pawn shops for example,” says Nichel.

“Bitcoin does not need a millennia’s worth of infrastructure for it to be exchanged,” points out Nichel. We have many exchanges that have popped up over the last 10 years. With this, Bitcoin’s institutional adoption is increasing and in turn has led to (somewhat of) a decrease in volatility, providing an easy access alternative for those in the Philippines.

Ethereum, Digital Oil?

Where Bitcoin is often referred to as ‘digital gold’, Ethereum can then be considered as ‘digital oil’, Nichel goes on to explain why:

“Ethereum isn’t just a ledger in the way that Bitcoin is,” explains Nichel. “Ethereum is a platform on which you can build decentralized apps (dApps)” on the blockchain. This is important because since the birth of the internet, we have relied on intermediaries (ePayment, digital marketplaces, etc.) to complete online transactions which charge fees for their services. Utilizing dApps on Ethereum’s blockchain eliminates this, culminating in decentralizing finance (DeFi).

What Is DeFi?

“Today, financial services are facilitated by intermediaries: payments, deposits and loans by banks, and stocks and bonds by brokers and dealers, explains Nichel. While this has worked well historically, the downside is both parties on either side of the centralized intermediaries lose bargaining power with varying fees for transactions. With DeFi, they facilitate these same services but decentralize them, reducing fees and increasing accessibility. With Ethereum, you can create peer-to-peer smart contract loans, privately between parties, stored on the blockchain, and completely decentralized. This eliminated the aforementioned intermediaries allowing for lower fees and faster transactions.

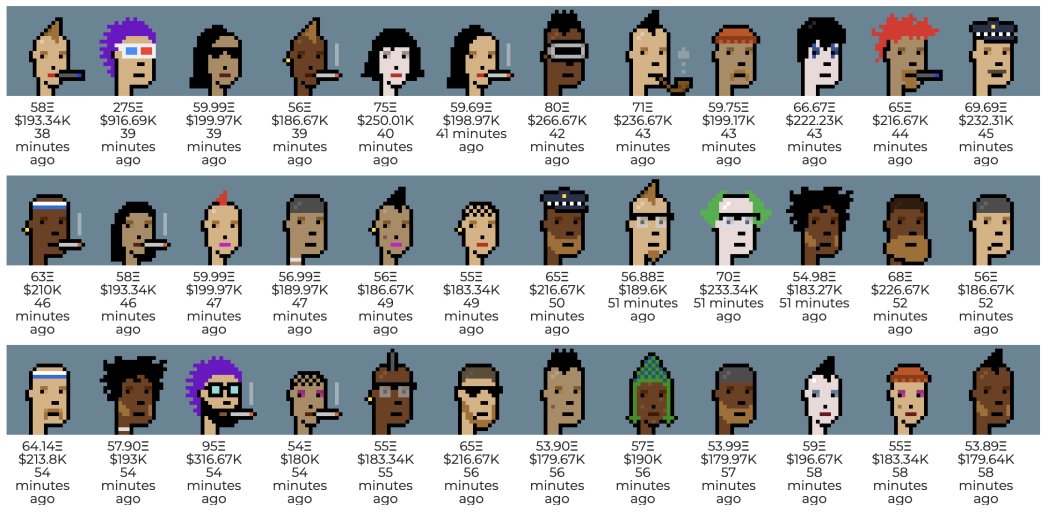

Demystifying NFTs

To close, Nichel shed some light on the current trend and hype around NFTs, what they are, and how they can be valuable investments: On Ethereum’s blockchain, you have non-fungible ERC-721 tokens, hence the term NFTs. “Think of NFTs as art; it’s scarce and collectible. The rarity of an NFT dictates its value” explains Nichel. “ERC-721 allows artists to create NFTs and make unequivocal transactions, stored on the blockchain.” Nichel goes on to explain that for example, for music, you can build NFT music in such a way that every time it gets played, a payment in crypto gets paid to the artist.

Nichel then explained the potential for NFTs in the future, saying that beyond art, the potential is there for some major disruption with NFTs. Records such as title deeds and national IDs can be stored onto the blockchain which cannot be tampered with.

Conclusion

Both Joshua and Nichel agreed that gold’s status as a safe haven asset will remain. Bitcoin will not replace physical gold as an asset class. Gold has stood the test of time holding value, acting as a mitigating factor and a strong hedge in times of financial crisis. However, Bitcoin is an investment worth considering; the entire cryptocurrency space is evolving and developing rapidly with new technology that could transform the way we do financial transactions, collect art, and store our data. How much you choose to invest in physical gold or Bitcoin all depends on your risk appetite.