Gold and US Elections: Understanding Gold’s Post-Election Safe Haven Appeal

Published on 12th November, 2024

Every four years, the US presidential election not only sets the country’s political and economic agenda, but also makes a key impact on the global financial markets. The uncertainty surrounding new domestic and foreign policies, shifting trade and economic priorities, and potential geopolitical challenges may leave investors scrambling to safeguard their wealth.

Gold, with its historic reputation as a dependable asset in turbulent times, becomes a focal point in the post-election period. As the international stock and bond markets react to political outcomes and currency values fluctuate, gold tends to be the preferred choice for those seeking financial stability.

Gold Price Trends During and After US Presidential Elections

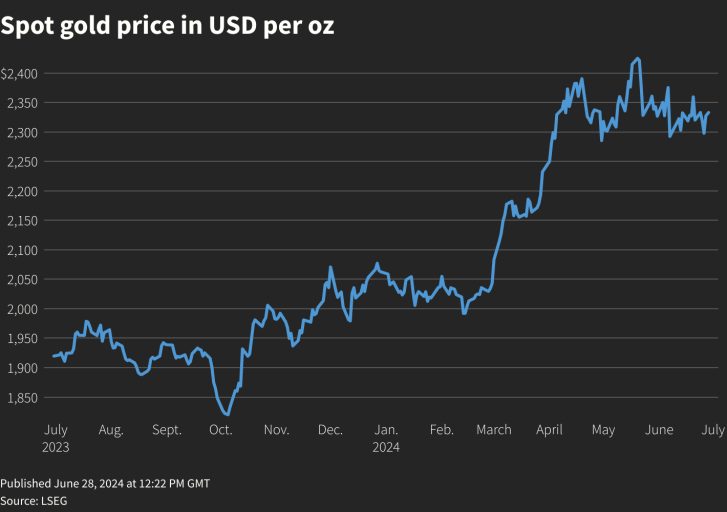

Data shows that US presidential elections almost always impact gold prices. Leading up to the 2016 election, the race between Donald Trump and Hillary Clinton drove a notable uptick in gold prices. Heightened anxiety in financial markets pushed gold to climb to $1,300 per ounce on November 4.

After Trump’s surprise victory, investor confidence in economic growth surged, which drove stock markets higher and reduced the demand for gold. Prices tumbled sharply, bottoming out at $1,128 by mid-December. By early 2017, gold had started to recover, edging back above $1,200 as market sentiment stabilized.

During the lead-up to the 2020 election, gold traded around $1,900, dipping slightly to $1,867 at the end of October. Following Joe Biden’s win, gold prices briefly rallied, jumping to $1,951 on November 6 as markets digested the transition. Based on this, the disputes, recounts, and legal challenges that followed caused gold prices to fall below $1,800.

It should be noted that over the longer term, both Trump and Biden’s presidencies have seen significant growth in gold prices. During Trump’s tenure, gold rose from $1,209 per ounce in January 2017 to $1,839 in January 2021, in large part due to the pandemic and policy related economic uncertainties.

Under the Biden administration, gold climbed from $1,871 per ounce at the start of his presidency to a record-breaking $2,740 by October 2024, driven largely by persistent and debilitating inflation and expectations of lower interest rates. These trends highlight gold’s enduring role as a preferred asset during periods of political and economic turbulence.

Inflation Expectations in the Post-Election Environment and How It Can Impact Gold Prices

The inflationary environment in the US remains a concern and consumer prices continue to experience upward pressure, with the Federal Reserve facing persistent challenges in achieving its long-term target of 2% inflation rate. Currently, inflation has moderated from its peaks, but remains elevated due to global supply chain pressures, over spending, and geopolitical tensions.

With Donald Trump re-elected as president, market analysts expect several of his proposed policies, including the continuation of tax cuts, increased tariffs, and deregulation, to play a pivotal role in shaping economic conditions. Proposals for significant tariffs, particularly on Chinese imports, are anticipated to push inflation higher by increasing costs for consumers and businesses.

For example, some forecasts suggest tariffs could add approximately 2.5 percentage points to inflation in the short term but with oil drilling to increase and lower gas prices, economic growth should materialize. As a result, gold, which is historically seen as a hedge against inflation, could experience increased demand, which can drive up its price. Remember, Trump has already been president and inflation was at a minimum.

How the New Federal Government’s Proposed Tariff Plans May Impact Gold Prices

Tariffs, especially those targeting key trade partners like China, can have significant implications for gold prices, largely due to their influence on market sentiment and inflation.

Tariffs tend to escalate trade tensions and lead to market volatility and heightened investor anxiety. Higher import taxes can lead to increased costs for businesses and consumers, fueling inflation. Apart from this, tariffs can also exacerbate fears of a global economic slowdown. The combined effect of these factors can drive up demand for gold as investors seek to hedge against geopolitical and economic instability.

Post-Election US Dollar Performance and its Correlation with Gold Prices

The performance of the US dollar following a presidential election is also a key factor that can influence gold prices. As gold is priced in dollars, their relationship is typically inversely proportional: when the dollar strengthens, gold tends to become more expensive, which reduces its demand. Pertaining to this, a weaker dollar generally boosts gold’s appeal and drives up prices.

Post-election shifts in fiscal and monetary policies often impact the strength of the US dollar. For instance, expansionary fiscal measures such as increased government spending or tax cuts can raise inflation expectations and weaken the dollar, as the Federal Reserve might delay interest rate hikes to avoid stifling economic growth. In such a scenario, gold could become a preferred hedge against inflation and currency depreciation, prompting a rise in demand and prices.

Inflation Expectations in the Post-Election Environment and How It Can Impact Gold Prices

The inflationary environment in the US remains a concern and consumer prices continue to experience upward pressure, with the Federal Reserve facing persistent challenges in achieving its long-term target of 2% inflation rate. Currently, inflation has moderated from its peaks, but remains elevated due to global supply chain pressures, over spending, and geopolitical tensions.

With Donald Trump re-elected as president, market analysts expect several of his proposed policies, including the continuation of tax cuts, increased tariffs, and deregulation, to play a pivotal role in shaping economic conditions. Proposals for significant tariffs, particularly on Chinese imports, are anticipated to push inflation higher by increasing costs for consumers and businesses.

For example, some forecasts suggest tariffs could add approximately 2.5 percentage points to inflation in the short term but with oil drilling to increase and lower gas prices, economic growth should materialize. As a result, gold, which is historically seen as a hedge against inflation, could experience increased demand, which can drive up its price. Remember, Trump has already been president and inflation was at a minimum.

Growing Geopolitical Tensions May Lead to an Increased Demand for Gold

Geopolitical instability is one of the most significant drivers of demand for gold as a safe haven asset. The ongoing war in Ukraine and tensions in the Middle East have made gold an appealing choice for investors looking to safeguard their portfolios amidst geopolitical uncertainty and economic volatility.

With increasing concerns about potential escalations in these conflicts, including the risk of broader NATO involvement in Ukraine and the possibility of a multi-front war in the Middle East, the demand for gold is expected to remain high in the short term.

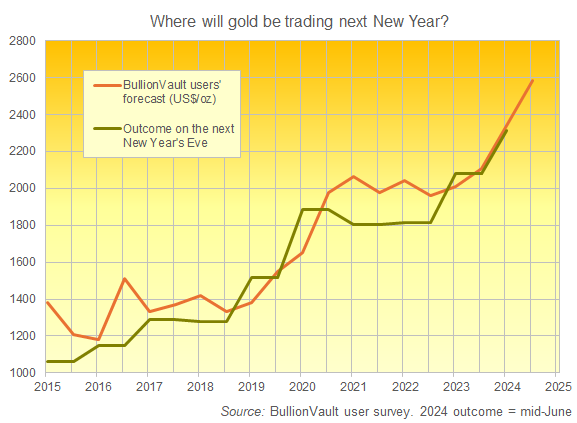

Gold Price Forecast for 2025

Gold is on track to exceed earlier price predictions, with Goldman Sachs forecasting it could reach $3,000 per ounce by the end of 2025. This bullish outlook stems from a combination of central bank purchases, geopolitical risks, and shifting investor sentiment.

Traditionally, gold prices move inversely to interest rates, as the precious metal offers no yield. Based on this, since 2022, an unprecedented surge in gold buying by central banks has shifted this dynamic, setting new price benchmarks. Goldman Sachs estimates that every additional 100 tons of physical demand increases gold prices by at least 2.4%. Emerging market central banks, spurred by concerns over financial sanctions and reserve diversification, have significantly increased their gold holdings since the freezing of Russian assets following the Ukraine invasion.

The report also highlights growing concerns among policymakers about the sustainability of US debt ($36 trillion, which is 125% of the nation’s GDP). With many central banks holding substantial US Treasury bonds, exposure to fiscal risks has prompted a pivot toward gold. Western investors are also revisiting gold as a hedge against potential geopolitical shocks, trade tensions, and economic uncertainties tied to the upcoming US presidential election.

This multifaceted demand suggests a strong upward trajectory for gold prices, solidifying its appeal as a resilient and strategic investment.

Invest in Gold with J. Rotbart & Co Today!

When it comes to investing in gold, trust matters. J. Rotbart & Co. is a family-owned boutique firm specializing in physical precious metals, offering unparalleled expertise and a personalized approach. Whether you want to buy, sell, or store gold, our global network and seasoned professionals can provide expert advice and provide secure, discreet, and efficient service.

With decades of experience in trading, logistics, and precious metals management, we can provide personalized solutions that meet your unique needs and goals. We can guide you through every aspect of your gold investment journey.

Contact us today using our online contact form or email us at [email protected] to find out how we can help you with your gold investment needs.