Gold Rush: Market Review February 2025

Published on 24th March, 2025

Key Trends:

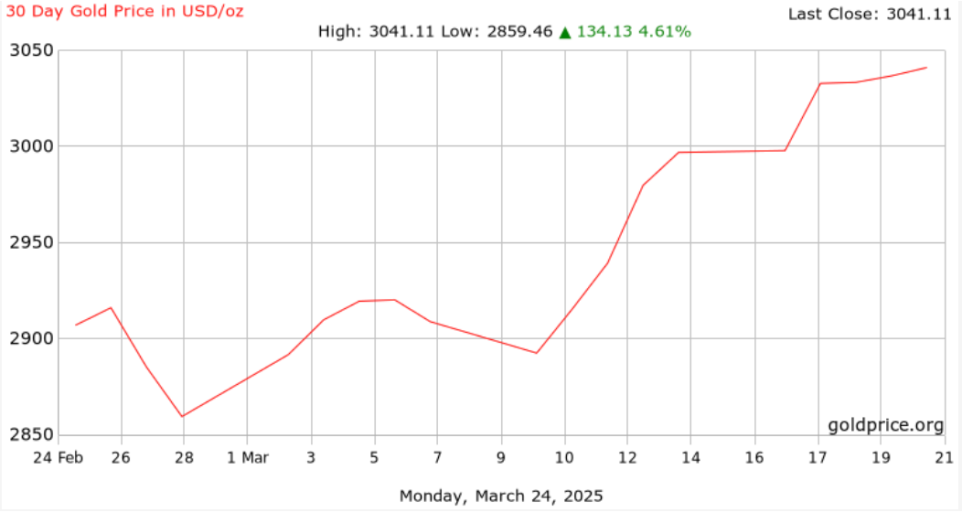

- Strong Upward Momentum: Gold has experienced a significant rally, continuing its upward trend from previous years. It has outperformed other assets, including equities and Bitcoin. Moreover, gold prices have reached record highs.

- Factors Driving the Rally: Geopolitical uncertainties, inflation concerns, central bank buying, safe-haven demand, weakening dollar index, and continued support from U.S. trade policies.

- Market Volatility: Despite the overall bullish trend, there have been periods of profit-taking and price fluctuations. The market is sensitive to economic data releases. There is a balance between the bullish trends, and the potential head winds of strong US treasury yields, and a strong dollar.

- Central Bank Activity: Central banks are actively increasing their gold reserves, contributing to the strong demand.

- Key Price Points and Technical Analysis: Gold has tested and, in some cases, surpassed the $2,900 per ounce level. There are predictions of gold potentially reaching $3,000 or even $3,080 per ounce in the near term.

February 2025 | Gold Price Review

5 Years Gold Price | Gold Price Review

Overall Outlook:

The overall outlook for gold remains bullish, with analysts expecting continued strength in the market. However, investors should be aware of potential volatility and economic factors that could impact prices.

Gold Strategies : March 2025

Key Market Influences in March 2025:

- Geopolitical Uncertainty: Continuing global tensions.

- Inflationary Pressures: Persistent inflation concerns supporting gold’s role as a hedge.

- Central Bank Policies: Federal Reserve and other central bank actions on interest rates significantly impacting gold prices. Central bank gold reserve accumulation.

- US Dollar Strength: The dollar’s performance inversely affects gold prices.

- Potential Tariff Impacts: The effects of new tariffs on global trade and their impact on inflation.

Brief Gold Strategies for March 2025:

- Diversification: Maintain gold as a core component of a diversified portfolio to mitigate risk. Allocate a percentage of assets to gold, balancing it with other investments.

- Strategic Accumulation: Consider accumulating gold during price dips.

- Monitoring Economic Indicators: Closely track inflation data, interest rate decisions, and geopolitical developments. Adjust gold holdings based on evolving market conditions.

- Risk Management: Implement stop-loss orders to limit potential losses during market fluctuations.

- Avoid Overexposure: Avoid overexposure to gold, maintaining a balanced investment approach.

In essence, March 2025 strategies should emphasize a blend of cautious optimism and proactive risk management.

Key Considerations:

Market conditions can change rapidly, and investors should stay informed. It is always advisable to consult with a financial professional before making any investment decisions.

Contact us today using our online contact form or email us at [email protected] to find out how we can help you with your gold investment needs.