Gold Rush: Market Review April 2025 & Gold Strategies May 2025

Published on 25th April, 2025

Key Trends:

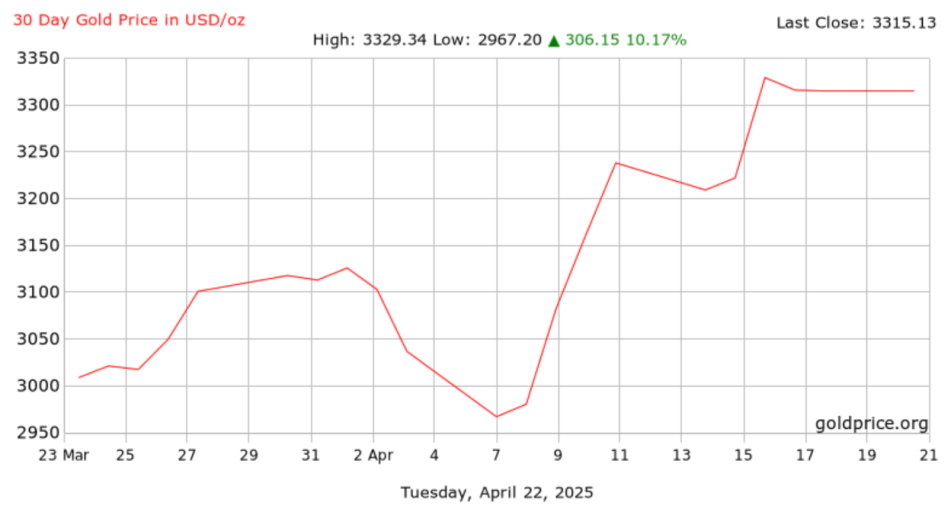

- Record Highs Fueled by Geopolitical Tensions: Gold surged to a new all-time high of USD $3,350/ozt in April as ongoing geopolitical crises—including escalating tensions in the Middle East and the South China Sea—heightened global risk aversion. Investors flocked to gold as a safe-haven asset amid fears of potential military escalations and supply chain disruptions.

- Weak U.S. Job Data Adds to Gold’s Appeal: April’s U.S. non-farm payrolls report came in below expectations, signaling a cooling labor market. Slower job growth increased speculation that the Federal Reserve may pause further rate hikes. This dovish shift in sentiment weakened the dollar and boosted demand for gold as a defensive asset.

- Sticky Inflation and Dollar Weakness Support Demand: April’s U.S. CPI rose 3.6% year-over-year, exceeding market expectations and signaling persistent inflationary pressures. Combined with a softening U.S. dollar index (DXY fell below 103) and slowing economic growth, gold retained its appeal as a hedge against both inflation and currency debasement.

- Heightened Gold Imports into China: China ramped up gold imports in April, reflecting both investor demand and strategic reserve expansion. With domestic economic uncertainty and a volatile yuan, gold served as a trusted store of value. This strong import activity added further upward pressure on global prices.

- Technical Breakout Confirms Bullish Structure: Gold decisively broke above the key resistance level of $3,000/ozt on April 7, signaling a powerful bullish continuation. This breakout ignited upward momentum, driving prices to a record high of $3,350/oz by April 17. The clean follow-through confirms a strong technical uptrend that remains firmly in place.

April 2025 | Gold Price Review

5 Years Gold Price | Gold Price Review

Overall Outlook:

April reinforced gold’s strong uptrend, fueled by global risk aversion, central bank buying, and inflationary pressure. With fundamentals and technicals aligning, the bullish momentum may extend into Q2—barring an unexpected shift in Fed policy or geopolitical easing.

Gold Strategies : May 2025

Key Market Influences to Watch in May 2025:

- U.S. Federal Reserve FOMC Meeting (May 14) – Any hint of rate cuts or policy shift could influence gold’s short-term momentum.

- Escalating Tensions in Taiwan Strait and Ukraine – Continued geopolitical instability may push investors toward safe-haven assets.

- Eurozone and China Economic Data Releases – May’s PMI and GDP data could affect global risk appetite and commodity flows.

- U.S. Dollar and Treasury Yields – If dollar weakness continues, gold could remain strong above USD 2,300.

- Gold Supply Chain Constraints – Delays in South African and Peruvian gold mining operations may further tighten supply.

Brief Gold Strategies for May 2025:

In essence, May 2025 strategies should focus on balancing opportunity and caution. With rising prices driven by inflation and global tensions, strategies centered on holding gold as part of a diversified portfolio, buying on dips, and watching key economic signals. Managing risk and avoiding overexposure were key to navigating the market’s ups and downs.

- Hold Core Allocation, Add on Pullbacks: With strong fundamentals and momentum, long-term investors are advised to maintain or increase gold exposure. Tactical accumulation on dips remains a favored approach.

- Diversification: Diversify holdings across multiple secure locations, such as Hong Kong, Singapore, and Zurich, to mitigate geopolitical and regulatory risks. There is also growing interest in smaller denomination bars and coins for liquidity flexibility.

- Avoid Overexposure: Avoid concentrating too heavily on gold. A balanced, diversified approach helps manage both upside potential and downside risk.

- Monitoring Economic Indicators: Closely track upcoming U.S. inflation data, interest rate decisions, and global geopolitical developments. Adjust gold holdings accordingly to remain aligned with evolving market conditions.

Key Considerations:

As gold eyes higher levels, volatility could increase in reaction to economic data or central bank comments. Investors should stay informed about Fed rate path expectations, and geopolitical developments, which may act as key sentiment indicators moving forward.

Contact us today using our online contact form or email us at [email protected] to find out how we can help you with your gold investment needs.