Gold’s Resurgence: China’s Central Bank Purchases and Geopolitical Tensions Drive Demand for Safe Havens

Gold has surged to a two-week high following the announcement that China’s central bank has resumed its bullion purchases for the first time in seven months. This development comes at a pivotal moment, as rising tensions in the Middle East, particularly the recent upheaval in Syria, are fueling increased demand for safe-haven assets. Investors are turning to gold as a safeguard against market volatility and geopolitical instability.

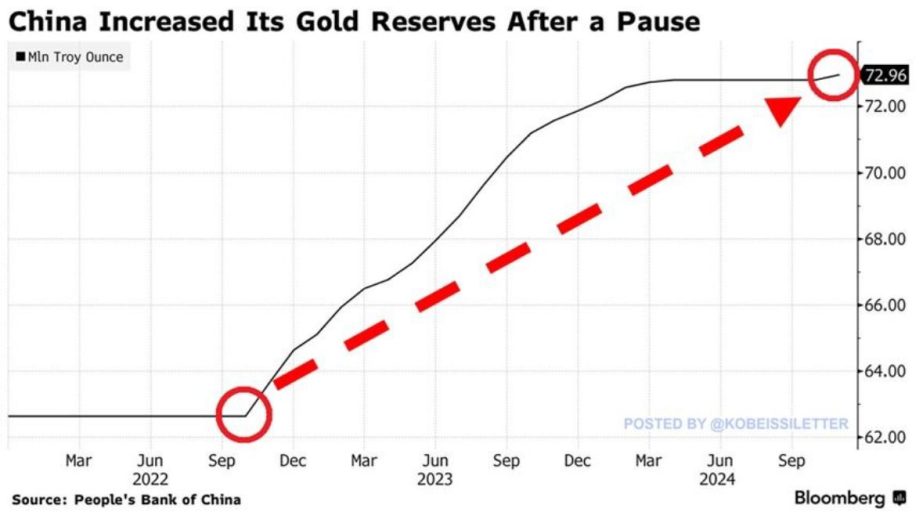

The People’s Bank of China (PBOC) has added 160,000 fine troy ounces to its reserves, reinforcing its strategy to diversify its assets and protect against currency depreciation. While this volume of purchases may seem modest compared to the significant buying trends seen earlier in the year, it emphasizes China’s commitment to maintaining a robust gold position amid shifting economic landscapes.

Market analysts are keenly observing these trends, as the potential for further geopolitical instability could enhance gold’s attractiveness as a safe haven. The situation in Syria, with its impact on regional stability, adds a layer of complexity that could drive more investors towards gold. Additionally, with inflation pressures being a focal point ahead of the Federal Reserve’s upcoming policy meeting, the outlook for gold remains optimistic. Lower interest rates typically benefit gold, as it becomes more appealing compared to interest-bearing assets.

For investors, it’s crucial to stay informed about these developments and their potential implications on investment strategies. Gold has consistently proven to be a reliable hedge in uncertain times, making it an essential asset to monitor. As we navigate these turbulent waters, understanding the factors influencing gold prices can provide valuable insights for building a resilient portfolio.

In summary, the combination of China’s renewed interest in gold and the backdrop of geopolitical tensions underscores the metal’s enduring value as a safe haven. Investors should consider how these dynamics could shape market trends and affect their investment decisions moving forward.