Precious Metals Markets : Q4 2018 – Q1 2019

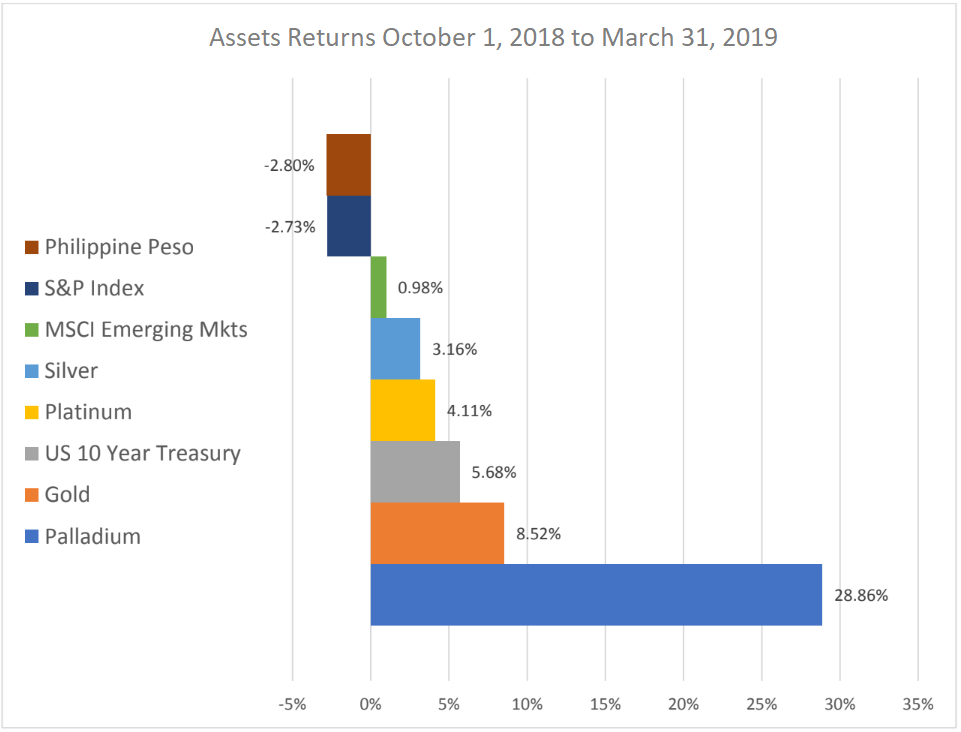

Precious Metals Markets: The last two quarters were good for holders of precious metals. The price of gold rose by 8.5% to $1,292 per ounce versus $1,191 at the end of Q3 2018. Silver strengthened by 3.2% to $15.1 per ounce. Platinum, ended the period up 4.1% while palladium skyrocketed by 28.9%. These all compare favourably to the Philippine Peso which lost 2.8% of its value versus the US dollar.

Meanwhile, the S&P stock index in the US fell 2.7% while Emerging Market equities rose by 1.0%. The 10-year US Treasury total return bond index rose 5.7% thanks to a steep drop in yields on US dollar risk-free debt.

The main themes for the past two quarters have been actions by the US Federal Reserve.

The Fed raised its benchmark interest rate by 0.25% in December to 2.5%. This raised concerns in global markets that the Central Bank policy might restrain growth in the US and around the world. However, in the weeks and month since that meeting, Federal Reserve officials have repeatedly sounded a more dovish tone which has helped to reassure markets that US policy will remain accommodative.

Precious Metals Markets, Attractive Alternative Investment

With US-China trade tensions and UK-EU negotiations remaining key sources of geopolitical uncertainty, interest rates are expected to remain at low levels across the developed world and in Emerging Markets. When cash in a savings bank account earns little return, precious metals become an attractive alternative.