Put Your Gold To Work

Published on 5th July, 2024

Most precious metals investors have a simple strategy of buy and hold. They consider their gold as an insurance policy, against inflation or an economic crisis, and are willing to let it sit in the vault for an extended period of time. They are confident that eventually it will preserve their purchasing power, or help them get through a rough patch. This is a legitimate approach, which we support wholeheartedly. It is suitable for the average investor, who is seeking to minimize risk. However, sophisticated investors who own a considerable amount of precious metals have other alternatives available to them. In this issue we will explain how you may put your gold to work.

J. Rotbart & Co. is offering its customers private loans, in which your bullion holdings serve as a collateral. This way you can utilize your capital in a productive way, while maintaining your exposure to precious metals. These funds can then be invested, for instance in a business or in real estate, and generate a return, without giving up on any potential price appreciation of your bullion. One may view this as a form of diversification, which allows our customers to invest in other asset classes, without having to to sell their gold or silver.

This form of credit is known as a “Lombard loan”, after the famous Italian banks of the renaissance era. It grants the owners of an asset immediate access to liquidity, without having to sell the asset itself. J. Rotbart & Co. accepts as collateral gold, silver, platinum or palladium bars and coins, which were minted by an LBMA or LPPM approved refinery. The bullion doesn’t necessarily have to be purchased from our firm. We may also accept bullion which was bought elsewhere, subject to inspection and assay, in order to assure its authenticity. Other assets such as gemstones and cryptocurrencies may be considered as well. Naturally, once a loan is approved the collateral will be deposited in our vaults for safe keeping.

This form of credit is known as a “Lombard loan”, after the famous Italian banks of the renaissance era. It grants the owners of an asset immediate access to liquidity, without having to sell the asset itself. J. Rotbart & Co. accepts as collateral gold, silver, platinum or palladium bars and coins, which were minted by an LBMA or LPPM approved refinery. The bullion doesn’t necessarily have to be purchased from our firm. We may also accept bullion which was bought elsewhere, subject to inspection and assay, in order to assure its authenticity. Other assets such as gemstones and cryptocurrencies may be considered as well. Naturally, once a loan is approved the collateral will be deposited in our vaults for safe keeping.

J. Rotbart & Co. grants loans of up to 80% of the value of gold bullion, and up to 75% of the value of silver bullion. For other assets this amount is available upon request. We offer attractive rates of interest, and flexible repayment options. For instance, you may choose to make monthly, quarterly, semi-annual or annual payments. We also offer “balloon loans”, in which the loan is paid back in a single lump sum. We process loan requests quickly, and require minimal documentation. This level of flexibility and efficiency is unique to our firm, and is not available at the average commercial bank.

In order to illustrate how such a loan may be used, let us consider the following scenario. Please keep in mind that the numbers mentioned here are strictly hypothetical, and are not legally binding. Let’s assume that a customer owns 200K USD worth of gold bullion, which are deposited in our vaults. Based on that gold, our firm is able to loan him 160K USD, at an annual interest rate of 9%. The customer invests these funds in a business, which generates a 20% return on capital. During this year, the price of gold appreciates by an additional 10%. Therefore, the customer earns a yield of 18.8%, which exceeds what they would have earned by merely holding gold bullion.

In order to manage the risk which is involved in these loans, J. Rotbart & Co. has a margin call policy. If for some reason the value of the collateral drops, and the loan to value ratio (LTV) rises above 85%, we will issue a margin call and ask you to increase the collateral or to pay back part of the loan, in order to bring this ratio back below 85%. This is a standard practice among investment banks which allow margin trading. Unfortunately, if the loan to value ratio rises to 93%, we will be forced to liquidate your collateral. This is an extreme measure which we do our best to avoid. Unlike other financial institutions, who would liquidate your position automatically, we try to work with our costumers in order to find a solution which satisfies both sides. It is our utmost goal to allow our clients to retain their precious metals positions, and not to be “shaken out” due to market volatility.

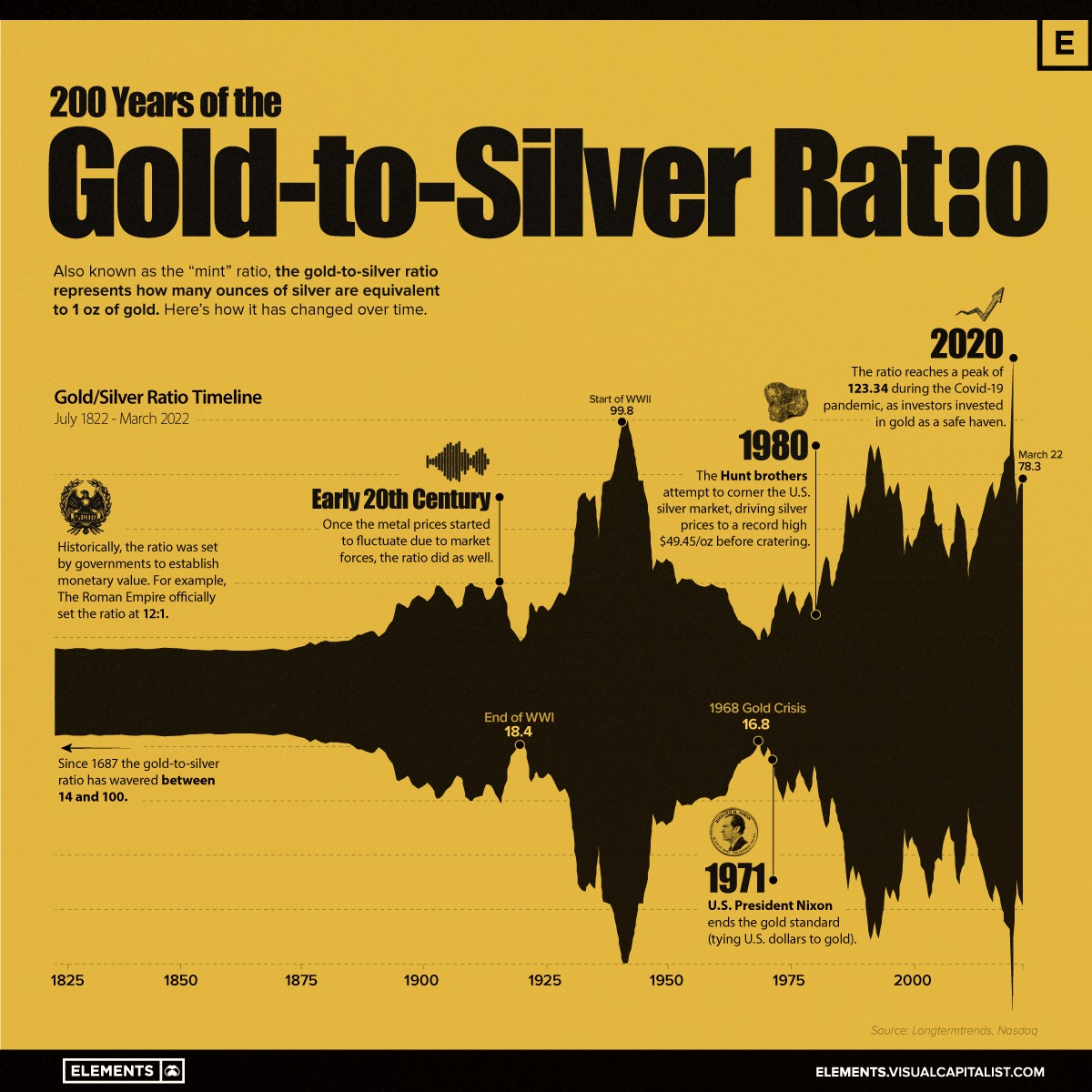

Under normal conditions, the prices of precious metals are quite stable, allowing ample time for customers to respond to margin calls and increase the value of their collateral. Nevertheless, on very rare occasions we may experience an outsized movement in the price. For instance, in March of 2020, during the onset of COVID19, the price of gold has dropped within five trading days by as much as 13.7%. Such an event may force our firm to respond accordingly. Customers should be aware of this risk, and take it into consideration.

Whether you are a beginner investor looking to build a portfolio or an experienced investor looking to diversity your portfolio, let us work with you to build and preserve your wealth through physical precious metals!

Get in touch with us today using our online contact form to schedule a free consultation with one of our precious metals experts.