Secure Your Wealth Offshore

Published on 7th June, 2024

In a world marked by economic volatility and political instability, the need to securely store and protect your wealth has never been more important. Understanding the various methods available for storing and securing your wealth is essential for developing a robust strategy that can safeguard your wealth against unforeseen circumstances and ensure a stable financial legacy for future generations which is vital in a high cost and inflationary world.

The Most Common Ways of Storing Wealth

When it comes to storing wealth, the two most common options available are home safes and safe deposit boxes at banks. Both options have their own advantages and limitations. These include:

At Home

Storing your assets at home can be a convenient option for you, as it gives you immediate access and complete control over your assets. It can also help you avoid the fees associated with banks and professional storage services.

The biggest disadvantage with storing your assets at home is that home safes can be vulnerable to theft. Your assets can also be damaged by fire, flood, or other natural disasters unless adequate protection is in place.

Safe Deposit Boxes at Banks

Safe deposit boxes at banks can be a secure option for storing your assets, as banks provide high levels of security including surveillance and alarms. The high level of security can also protect your assets against the risk of natural disasters to a great extent.

The downside is that the contents of safe deposit boxes are generally not insured by the bank. Also, access to safe deposit boxes is usually restricted to bank hours, which might not be convenient for all situations.

Why Choose Offshore Storage Facilities to Store Your Wealth

Storing wealth in offshore storage facilities offers several distinct advantages compared to traditional storage options like home safes and bank safe deposits. These include:

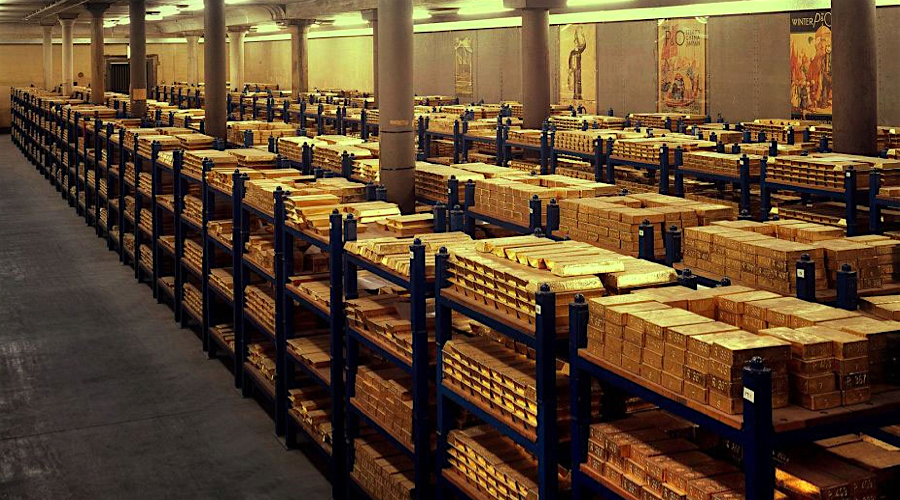

Advanced Security

Offshore storage facilities employ cutting-edge security technologies including biometric access controls, 24/7 surveillance, and secure vaults that are designed to withstand natural disasters and unauthorized access.

Asset Protection

Offshore storage facilities generally offer comprehensive insurance coverage tailored to the value and nature of stored assets, which can provide an additional layer of security for your assets.

Enhanced Privacy and Confidentiality

Most offshore jurisdictions have stringent privacy laws that protect the identity of asset holders. It ensures that your ownership details remain confidential and cannot be easily accessed by unauthorized parties.

Increased Protection from Domestic Economic and Political Issues

Storing your assets offshore can protect them from a wide range of risks including domestic political and economic uncertainties like changes in government policies and economic downturns.

Legal Protection

Most offshore jurisdictions have robust legal frameworks designed to protect assets from seizure, nationalization, or other forms of governmental intervention. They can also protect your assets from domestic creditors and legal claims, as they have strong debtor-friendly laws in place that can make it difficult for creditors to access stored assets.

Why Buying Physical Assets is Prudent for a Precious Metals Investor

Complete Control and Ownership

When you invest in physical precious metals, you own the assets outright. It can provide a sense of security and control that is not possible with paper-based investments or digital assets.

Immediate Accessibility

Precious metals are highly liquid and can be easily converted into cash any time you want, anywhere in the world. It ensures that you can access your funds when needed without lengthy processes or waiting periods.

Intrinsic Value

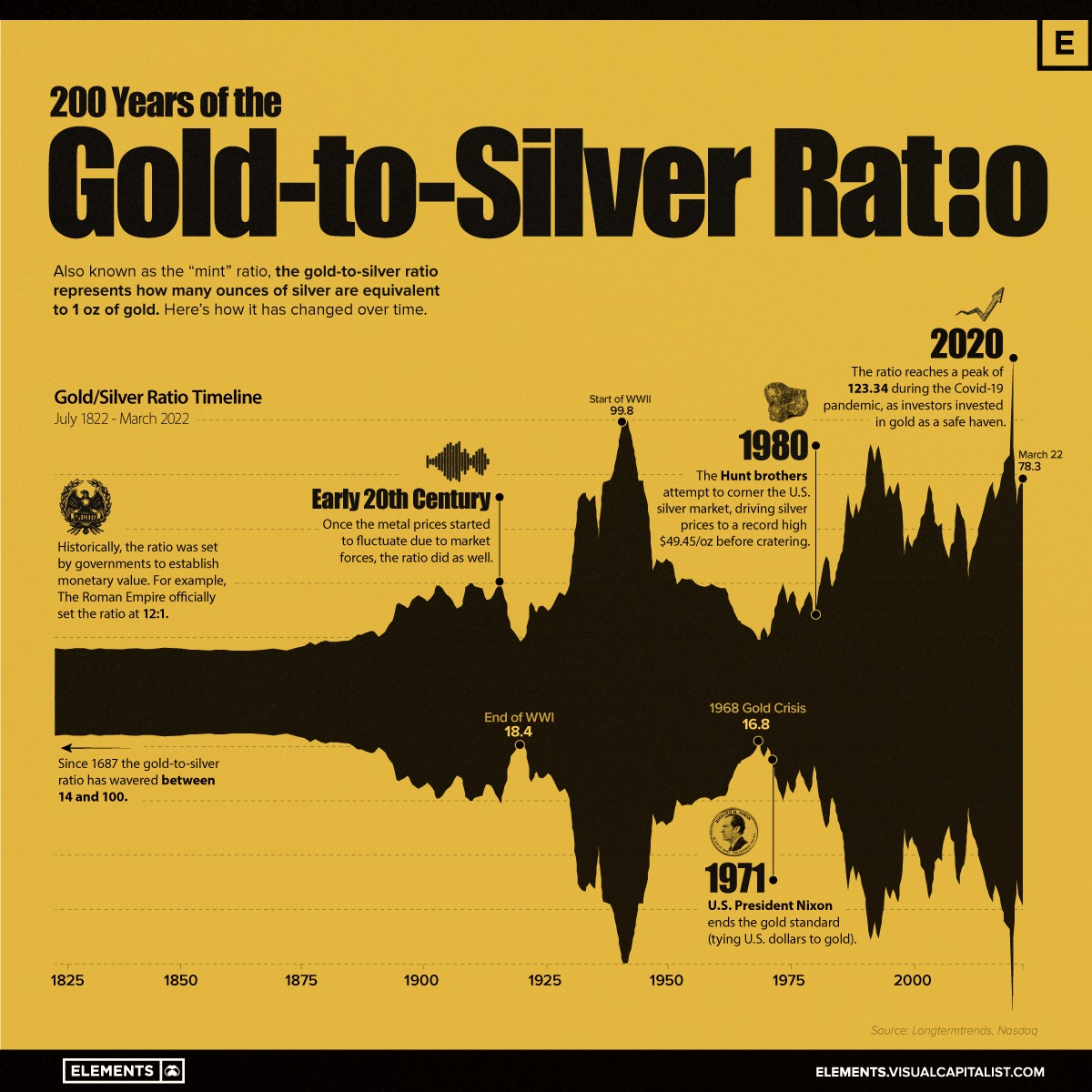

Precious metals are physical, tangible assets with intrinsic value. Unlike stocks or bonds, their value is not dependent on the performance of a company or government.Precious metals have a long history of maintaining their value over time. Gold, in particular, is known for its ability to preserve wealth through inflation, deflation, and periods of market volatility. In 2023, the annual average return of gold was 13.1%. The annual average return of gold over the last 50 years was 7.98% – on par with the average return rate of commodities and higher than US bonds.

Stable Returns

Precious metals have a long history of maintaining their value over time. Gold, in particular, is known for its ability to preserve wealth through inflation, deflation, and periods of market volatility. In 2023, the annual average return of gold was 13.1%. The annual average return of gold over the last 50 years was 7.98% – on par with the average return rate of commodities and higher than US bonds.

Choose a Reliable Way to Protect Your Physical Assets: J. Rotbart & Co.

When it comes to storing your precious metal holdings, you have several options including private vaulting facilities and safe deposit boxes at banks with private wealth programs and increased liability coverage. However, storing your physical assets with J. Rotbart & Co. offers several advantages that are not available with conventional options. These include:

Customized Global Storage Solutions

J. Rotbart & Co. provides bespoke storage solutions that cater to your unique needs – ranging from small safety deposit boxes to large private safes and vaults. You have the flexibility to store a variety of valuables, including precious metals, documents, fine art, and family keepsakes, ensuring that all your prized possessions are securely protected in one place.

Global Reach and Strategic Locations

With access to secure facilities in strategic locations around the world – including Hong Kong, Singapore, Bangkok, Wellington, New York, Los Angeles, Toronto, London, Zurich, Geneva, and Frankfurt, you can choose the most convenient and secure location for your assets. Upon request, J. Rotbart & Co. can also provide bespoke storage services in other locations and make sure your assets are stored where you prefer.

State-of-the-Art Security

Our storage facilities are equipped with the latest security technologies – including monitoring, alarms, sensors, fire, and climate control systems. This ensures that your valuables are protected against theft, damage, and environmental factors. Unlike traditional bank vaults, you can access your storage space 24/7/365. Moreover, CCTV systems track every corner of our facilities around the clock, providing continuous surveillance and security.

Full Liability Coverage

J. Rotbart & Co. ensures that all holdings are covered by one of the industry’s most extensive insurance policies. We take full liability for the physical loss of goods, providing you with peace of mind knowing that your assets are protected by robust insurance coverage.

Value-Added Services

Many of our storage facilities are located in tax-free zones and bonded warehouses, offering potential tax advantages and facilitating easier international trade and transfer of assets. J. Rotbart & Co. also offers secure global shipping services, enabling you to transport your valuables safely to any of our strategic locations with confidence.

Offshore storage facilities offer a variety of benefits – ranging from increased privacy to high levels of security, extensive liability coverage, tax advantages, and protection against domestic legal risks. By choosing to store your wealth with J. Rotbart & Co, you can benefit from comprehensive, secure, and flexible storage solutions that can not only protect your assets, but make it easier than ever before for you to access and manage them as well.

Contact J. Rotbart & Co today by filling out our online contact form or email us at [email protected] for a free consultation with one of our experienced precious metals experts.

Whether you are a beginner investor looking to build a portfolio or an experienced investor looking to diversity your portfolio, we can help you invest in the right precious metals.

Get in touch with us today using our online contact form to schedule a free consultation with one of our precious metals experts.