Three Things You Didn’t Know About Silver Investing

Worries over a slowing Chinese economy are once again highlighting the importance of Silver investing and investing in precious metals as a whole. And many investors see bargains as the price of silver is so low.

Silver Investing For the Future

But with demand for physical supply outpacing supply, silver is not easy to get – meaning the pricing may be surprising to some investors.

Concerns over China have prompted many to consider putting their money in gold and other precious metals as a safe haven. However, markets have been pushing back against the bad economic news this month, and silver fell to $14.64 an ounce on Sept. 1.

Steady slide For Silver Investing

The dip marks another low for silver prices, which have dropped dramatically from a high of $49.21 per ounce on April 29, 2011. Some say that silver (like gold) is an old-school commodity – bright past, gloomy future.

So: No one is buying silver. Meaning there should be plenty of it to go around. And it should be a bargain.

Right?

Nope!

Here’s what we see:

Demand for physical silver investing is high

The summer’s steady drop in prices has sent many Silver bullion investors bargain hunting. The low prices, combined with China’s uncertain outlook, mean many are looking to put money into precious metals.

Inventory is scarce – investing in physical silver is hard

There’s not enough silver bullion to meet demand.

Our experience is that buying physical silver isn’t easy. Clients need to be placed on waiting lists as refiners try to catch up with demand.

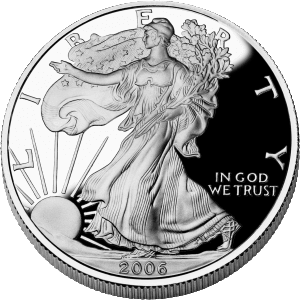

The U.S. Mint had to suspend sales of silver coins for three weeks this summer after it sold out. The U.S. Mint and the Royal Canadian Mint have both had to ration sales of silver investing.

Both the U.S. Mint and the Royal Canadian Mint

continue to run into serious issues keeping up with retail silver coin demand.

Consumers end up paying more

High demand for physical silver combined with a scarcity of metal means higher prices for consumers. Combined, these factors should have led to higher prices.

Lower precious metals prices on Wall Street aren’t necessarily

bringing lower prices on Main Street.

ValueWalk

As many claims, the prices are set based on trades in “paper” contracts and not based on actual demand for physical Gold. Some even claim that in the future, prices of physical precious metals will only be set based on demand for physical.

Our takeaway

In the world of physical precious metal investing, the laws of supply and demand are twisted into unexpected paradigms, so having a long-term strategy is paramount.

- When prices drop, physical demand often goes up. However, the demand for physical silver usually doesn’t affect prices. That’s because physical trades make up only a small amount of futures exchanges, which are highly leveraged.

- Buyers can get more bullion per dollar when prices fall. The amount of physical silver available then falls even faster.

Malca-Amit Precious Metals Services provides you with a one-stop solution for silver:

- Sourcing

- Buying

- Transporting

- Storing

To learn more, please contact us.