Silver Market Review – The Impact of Tariffs and Geopolitical Shifts

Updated on 27 May, 2025

As of 27 May 2025, silver price is trading at $33.5 per ounce, reflecting a 14.39% increase year-to-date. However, the market has experienced volatility due to ongoing geopolitical tensions and concerns over industrial demand.

The gold-to-silver ratio remains elevated, hovering above 100:1 (Discovery Alert), indicating that silver may be undervalued relative to gold. Analysts suggest that this disparity could present a tactical opportunity for investors, especially as silver’s dual role as both a precious and industrial metal continues to attract attention.

Looking ahead, forecasts predict that silver prices could reach between $36 and $38 per ounce in 2025 (Capital.com) driven by sustained industrial demand and macroeconomic factors.

Published on 6th May, 2025

In 2025, the silver market is making headlines – From rapid price increases to unexpected supply bottlenecks, this once-steady commodity is now behaving more like a volatile tech stock. Silver has surged more than 17% since the start of the year (Bloomberg), making it one of the best-performing assets this year.

What are the drivers for this surge? Part of the answer lies in its growing use in solar panels, electronics, and electric cars. Another driver is the new U.S. tariff regime, which is causing global trade tensions and supply problems – Silver is moving rapidly from London to New York to leverage higher prices, and making it scarce in other locations.

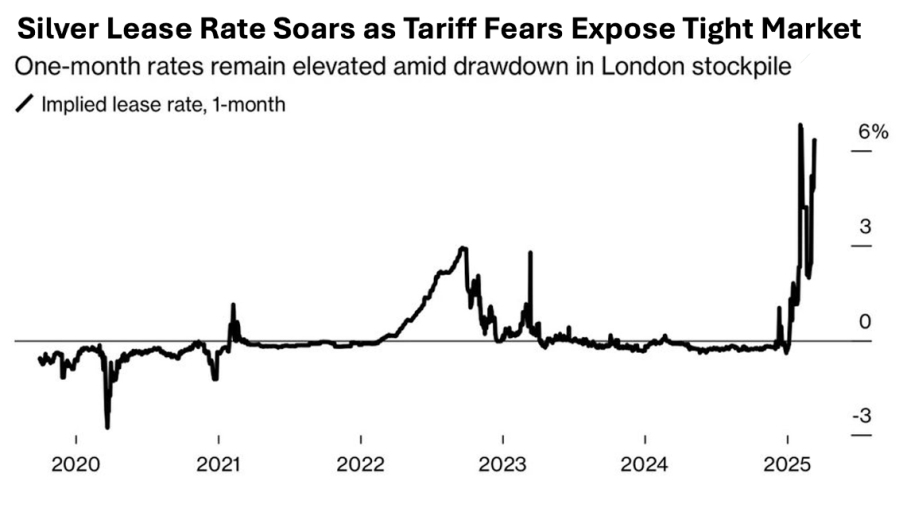

Additionally, lease rates – the cost to borrow silver – are spiking. This serves as an indicator for the tightness of the market. Together, these issues have made silver a hot ticket item for both investors and traders this year.

Let’s take a closer look at what’s going on, why it matters, and what might happen next.

Silver Price Action in Q1 2025: From Recovery to Rally

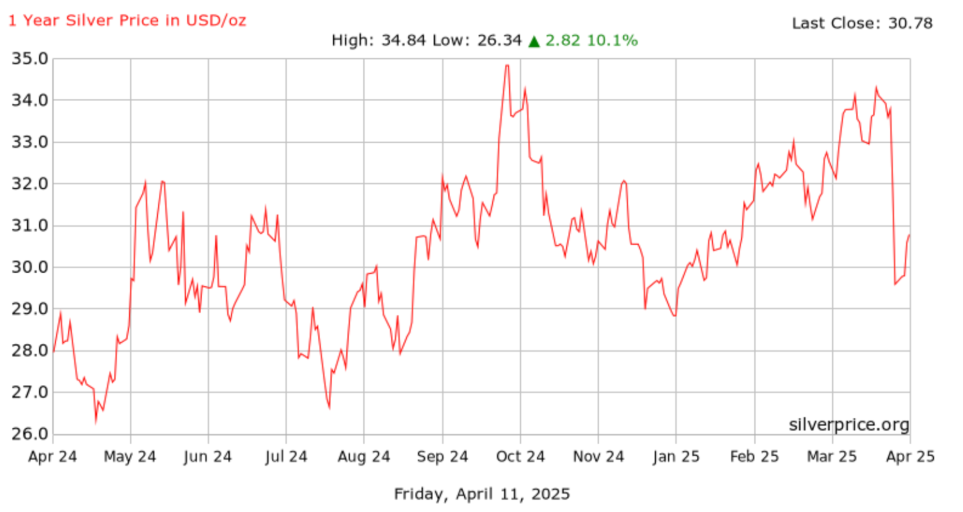

Silver prices surged to US$34.72 per ounce in October 2024 before entering a correction, ending the year at US$28.94 on December 30. The decline was driven by profit-taking and a stronger U.S. dollar. However, the pullback proved short-lived.

In early 2025, silver rebounded. It opened at US$29.53 on January 2 and crossed the US$30 threshold by January 7, supported by growing geopolitical risks and concerns over tight physical supply. By the end of January, silver had risen 6% to US$31.28.

Momentum continued through February, underpinned by robust industrial demand and rising lease rates—indicators of a tightening market. The price peaked at US$32.94 on February 20 before easing to US$31.13.

March marked the strongest performance, with silver holding above US$32 amid escalating trade tensions and ongoing supply constraints. It climbed to US$34.43 on March 27, approaching the October 2024 peak.

The rally stalled in early April. On April 1, silver dipped to US$33.67, then dropped below US$30 following a surprise policy announcement by President Donald Trump – New tariffs on metals and industrial imports, along with retaliatory actions from Canada, unsettled markets and triggered a broad selloff in risk assets, including silver.

1 Year Silver Price in USD per Ounce (Silver Price)

Silver’s 2025 Rally: What’s Fueling the Fire?

Silver reached $34 per ounce in early April 2025, marking a gain of more than 17% since the start of the year (Bloomberg). On the New York Comex, futures prices climbed even higher, reflecting a strong premium for physical silver in the U.S. market versus international counterparts.

Unlike gold, which moves largely on investor sentiment, silver plays a dual role. It acts as both a store of value and a key industrial input. As a result, its price is influenced not just by global risk factors, but also by industrial demand — particularly from sectors like electronics, solar power, and electric vehicles.

1. The Trump Tariffs and Trade War: A Catalyst for Silver Disruption

One of the primary geopolitical drivers behind silver’s surge in 2025 has been the renewed use of aggressive U.S. trade policy under the Trump administration. The reinstatement of reciprocal tariffs—especially on imports from key partners like Mexico and Canada—has unsettled commodity markets, and silver is no exception.

The U.S. relies on Canada and Mexico for roughly 70% of its silver imports. With new tariffs in place, these trade routes are facing significant disruption. In response, Canada imposed a 25% tariff on over $21 billion in U.S. goods as of late March (CNBC). If such measures remain in force, the silver trade could face growing fragmentation, higher transaction costs, and increased price volatility across global exchanges.

2. Lease Rates Signal Stress in the System

A key sign of stress in the silver market is the sharp increase in lease rates—the cost of borrowing silver on a short-term basis. These rates, typically stable and low, jumped above 6% in March 2025, following a similar spike in February. According to Bloomberg, this is the highest level seen since the global financial crisis.

Such rate hikes usually point to low inventory levels or increased demand for physical delivery—and in this case, both factors are at play. The pressure is particularly acute in London, long regarded as the central hub for silver clearing. Stockpiles there dropped to historic lows last month. Compounding the issue, a large portion of the remaining silver is locked within exchange-traded funds (ETFs), making it unavailable for lease or immediate trade.

3. Industrial Demand Remains Strong

Despite geopolitical uncertainties, the robust industrial demand for silver continues to underpin its bullish outlook. Silver is essential in key sectors such as solar energy, electric vehicles (EVs), and advanced electronics. According to the Silver Institute, global silver demand is expected to reach a record 1.2 billion ounces in 2025, primarily driven by the transition to green energy and the ongoing electrification of various industries.

Looking ahead, the China PV Industry Association (CPIA) projects between 215 GW and 255 GW of new solar capacity in 2025, with each unit requiring a significant amount of silver. While this forecast represents a decline of 8% to 22% compared to the record-breaking 2024 figures, it still signifies substantial investment in solar infrastructure (PvTech).

In parallel, the growing adoption of silver-intensive components in electric vehicles is further bolstering silver demand. Due to its superior conductivity and ductility, silver enhances the efficiency of EVs by enabling lightweight, yet durable, electrical connections between batteries and other vehicle components. On average, battery electric vehicles contain between 25 to 50 grams of silver—more than double the amount found in a traditional internal combustion engine vehicle. As global EV production accelerates, silver’s industrial role is set to expand further (Sprott).

What’s Next for Silver Prices?

Looking forward, the silver market is poised at the intersection of several growth drivers and potential challenges. On the positive side, sustained industrial expansion, government incentives for green energy, and growing investor interest could propel prices to new heights. Conversely, geopolitical instability, supply chain disruptions, and shifting monetary policies could introduce volatility or trigger temporary price corrections.

However, one thing is clear: silver is no longer a secondary asset. It has become a key player in today’s multifaceted global economy, and investors must carefully weigh both its opportunities and inherent risks.

How J. Rotbart & Co. Can Help

In today’s volatile environment, partnering with a reliable precious metals provider is more crucial than ever. At J. Rotbart & Co., we specialize in the buying, selling, storage, shipping, and financing of precious metals—gold, silver, platinum, and palladium—serving clients globally.

Whether you’re an experienced investor seeking physical delivery, a corporate entity managing supply chain risks, or an individual aiming to diversify your investment portfolio, we offer insured, internationally recognized precious metals solutions tailored to your specific needs.

Our team of specialists is committed to helping you safeguard your wealth, mitigate global risks, and make well-informed decisions in an increasingly dynamic market.