The Metal Of The Future

Published on 19th March, 2024

Most people are unaware of the importance of silver in the global economy. From a metal which was mainly used to produce jewelry and old fashioned cutlery, it has transformed in recent years into a vital industrial resource, which is in short supply. The demand for silver appears to be insatiable, while supply is scarce and gradually declining. In this article we will review the major industrial applications of silver, understand its unusual market structure, and explain why we believe it has tremendous potential to increase in value in the coming years.

What are Silver’s Edges in Industrial Uses?

Of all the elements, silver has the highest electrical conductivity. It is also extremely malleable and ductile, and has an excellent thermal conductivity. Therefore it is essential for the manufacture of electronics. In every application in which response time is critical, engineers prefer silver wires over copper. Circuit boards which operate at a high frequency are often plated with silver, in order to improve their performance and protect them from corrosion. Conductive inks which are made of silver nano-particles are printed on lightweight materials, in order to create membrane switches, wearable devices and flexible displays. Silver oxide batteries are highly reliable, and have the ability to maintain a nearly constant voltage output during discharge. Each of these devices requires only tiny amounts of silver, but they would be impossible to produce without it. According to the silver institute, 221 million ounces of silver were consumed by the electronics industry in 2023 (excluding photovoltaics), which is more than a quarter of the entire global mine supply. Now that the AI revolution is in full swing, we can only expect this demand to increase.

Next, silver is a major component in the manufacture of solar panels. It is turned into a paste and used in order to conduct the electricity which is generated in the silicon layer. An average panel of approximately two square meters contains up to 20 grams of silver, and therefore this industry is a large consumer of the precious metal. According to the silver institute, 161 million ounces of silver were used to produce solar panels in 2023. This amount represents 19% of the entire global mine supply, and a 15% increase compared to 2022. At the rate in which solar energy is expanding, it could become the leading consumer of silver within a few years. Attempts are being made to replace this silver with cheaper metals, such as copper. But the use of copper in solar cells poses technical difficulties, such as oxidation and diffusion into the silicon layer. Thus far, no company has been able to present a viable replacement, which is both reliable and cheaper to produce. So long as the price of silver is stagnant, the industry does not have a strong enough incentive to transition to other metals, and the massive consumption of silver is expected to persist.

Another growing demand for silver comes from the automotive industry. Compared to internal combustion engine vehicles, which consume an average of 15-28 grams of silver per unit, electric vehicles require an increased amount of 25 to 50 grams. During 2022, EV sales exceeded 10 million units, which represents 14% of all new cars sold in that year. As we progress with the green revolution, the number of EVs on the road is expected to grow and eventually outstrip that of traditional vehicles.

Silver is also used in more traditional industries. For instance in brazing and soldering alloys. The addition of silver improves heat conductivity and ductility, and produces a smooth joint which is resistant to corrosion. These alloys are used everywhere from water pipes and cooling tubes, to automobiles and airplanes. Another important application of silver is as a catalyst in the production of chemicals such as ethylene oxide and formaldehyde. Ethylene oxide is needed to produce detergents, plastics and fabrics. Formaldehyde is used to produce resins, adhesives, and solvents. Many of the products we use in our everyday life exist thanks to the catalytic properties of silver.

Last but not least, silver has natural anti-microbial properties. Silver ions have the ability to penetrate the cell walls of bacteria and disrupt their growth. Therefore it has many applications in the field of medicine. Medical devices such as catheters and breathing tubes are often coated with silver in order to keep them sterile. Creams which contain silver particles are used to treat burns, and prevent them from becoming infected. These properties are also useful for water filtration and purification. The use of silver in swimming pools and spas helps keep their water clean, and reduces the need for harmful substances.

Why Are There Supply Constraints?

As you can see, silver is essential for many high-tech industries, and plays a vital role in the electrification of our planet. However, its supply is far from guaranteed. Silver is a rare substance, and its average concentration in the Earth’s crust is only 75 parts per billion. By comparison, it is only 15 times more abundant than gold, whose concentration stands at 5 parts per billion. However, its price has been stagnant in recent years, and it is currently traded for less than half of its all time high of 50 USD per ounce. As a result, industrial consumers have no incentive to cut back their consumption, and mining companies have no incentive to increase their production. According to the silver institute, physical demand for silver has exceeded supply in the past three years. This deficit is gradually draining the above ground inventories, and eventually could lead to a shortage. As a matter of fact, the American Chemical Society has identified silver as one of nine elements in the periodic table which face serious supply limitations in the coming year 8.

Silver is an unusual resource, in the sense that it is mainly produced as a by-product of the mining of other metals. As of 2020, 57% of the global silver supply came from the mining of copper, lead and zinc. Another 15% came as a by-product of the mining of gold. Only 26% of the global supply came from primary silver mines. This means that the supply of silver is highly dependent on the demand for base metals. Take for instance the Escondida mine in Chile, which is the largest copper mine in the world. Although it produced 5.3 million ounces of silver in 2022, this represented less than 2% of its overall revenue. It is highly unlikely that any change in the price of silver will affect this mine’s operations. However, if for some reason the demand for copper declines and the Escondida mine is forced to shut down, this will reduce the global supply of silver by 0.63%. Even when it comes to primary silver producers, there is no ability to ramp up production overnight. After many years in which silver miners were unable to turn a profit, there is a dearth of investment in this field. Even if the price of silver rises considerably, it would take years before supply increases accordingly. Therefore we claim that the supply of silver is largely insensitive to its price. Even if it rises substantially, we do not expect to see any increase in supply for many many years.

Is Silver Undervalued?

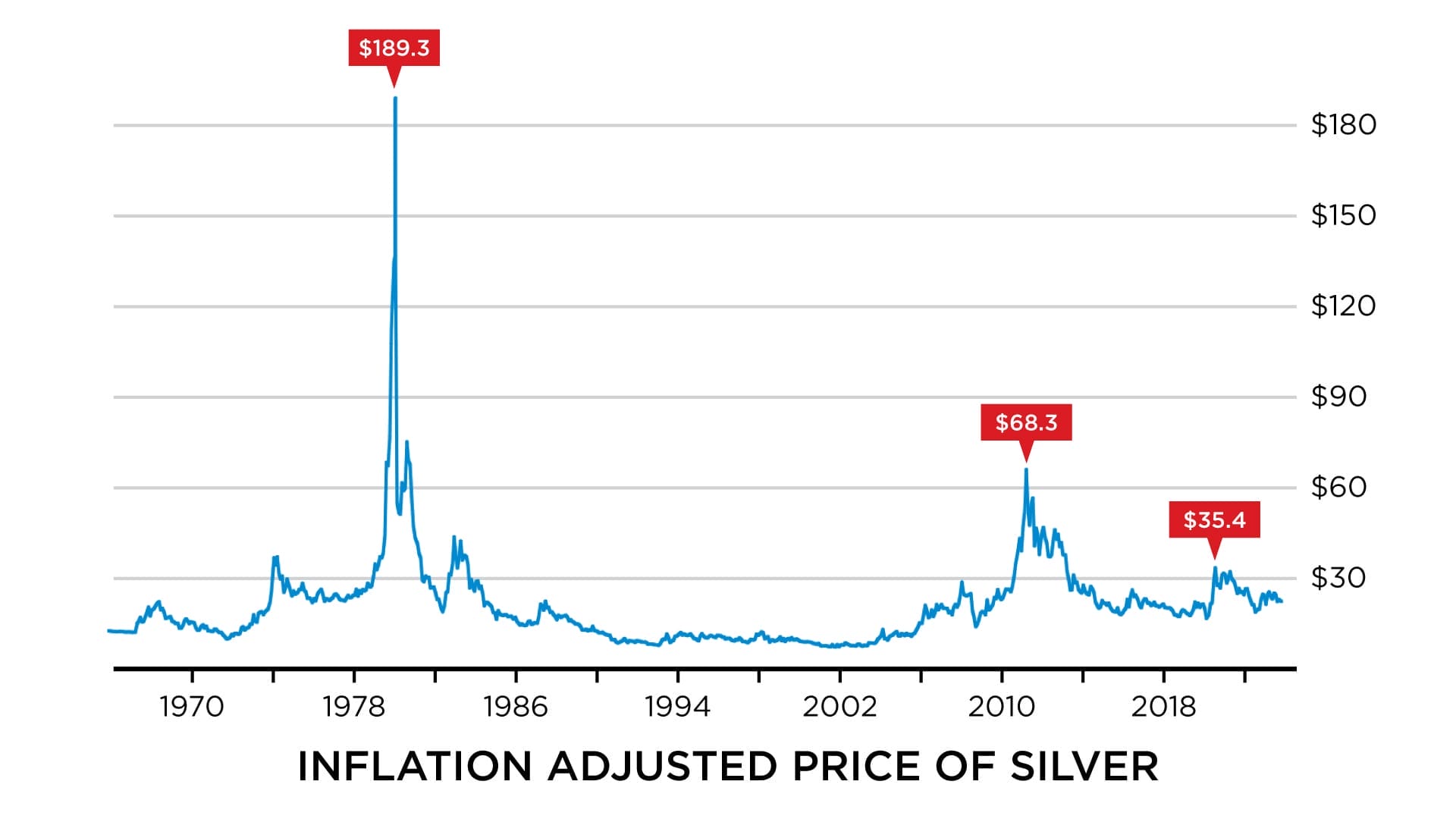

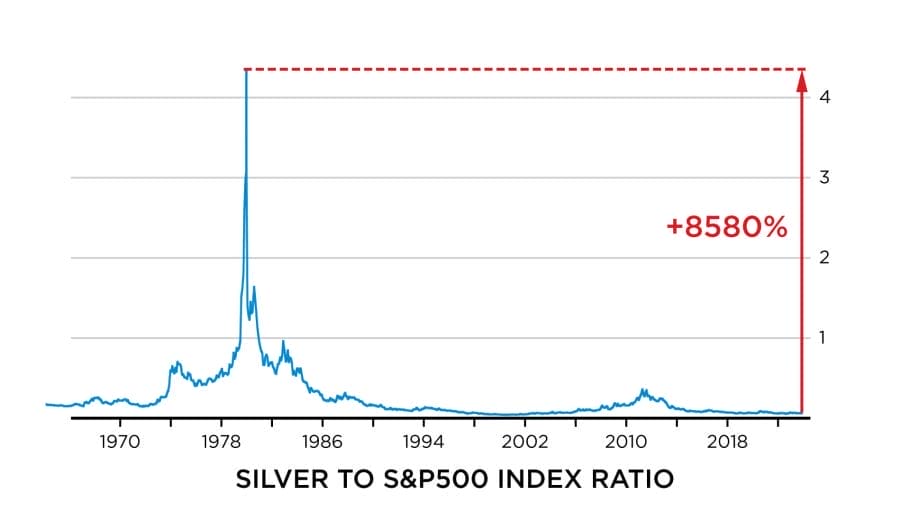

In order to get an idea of how undervalued silver currently is, we can adjust its price for inflation. As you can see from the chart, in terms of present day dollars, the 2020 high is equivalent to 35.4 USD per ounce. The 2011 is equivalent to 68.3 USD, and the 1980 high is equivalent to no less than 189.3 USD. Another indicator is the comparison of the price of silver to the S&P 500 index. The rationale behind this comparison is that as we’ve already established, silver is an important industrial resource, and the purchasing power of the companies which consume it on a regular basis is proportionate to their share price. The undervaluation here is even more extreme. In order to reach the same proportion with the S&P 500 index as it had in 1980, the price of silver would have to rise by no less than 8580%. We do not argue that this will ever happen, and yet we find this piece of data to be be eye-opening.

What Are The Best Ways You Can Invest In Silver?

Since silver is much cheaper than gold, its costs of shipping, storage and insurance are much higher, as a percentage of the value of the bullion. However, it also has a higher potential to appreciate in value than gold. For instance, during the rally in precious metals between the years 2000 and 2011, the price of gold increased by about 8 fold, whereas the price of silver increased by about 12 fold. The added costs are the price we need to pay for that potential. Another downside which we need to mention comes in the form of a higher degree of volatility. The price of silver can be highly volatile, and investing in it is not suitable for the faint of heart. In order to hold it long term, one must have a strong conviction, that its fundamentals are strong, and that its price will eventually come to reflect that. We can say with confidence, that after three years of consolidation above the 20 USD level, it probably doesn’t have much down side. Even if we do get another financial crisis, like the one we experienced in 2008, its price decline will most likely be short lived, and after that it will be able to advance to new highs.

As we stand on the cusp of a fifth industrial revolution which is expected to usher in an era of clean energy, there has never been a better time to invest in silver. At J. Rotbart & Co, we have highly knowledgeable and experienced professionals who can help you with precious metal investments. We can assess your needs and create personalized solutions to help you meet your investment goals. Contact us today by filling out our inquiry form or email us at [email protected] for all your gold and other precious metal needs.