The Trump Presidency and Its Influence on Gold Prices: A Look Back and Ahead

Published on 15th February, 2024

The relationship between US presidential policies and gold prices has long been a subject of interest for investors and economists. As President Donald Trump embarks on his second term, it’s critical to examine how his administration’s policies have historically influenced gold prices and what the future might hold.

Historical Context: The First Term

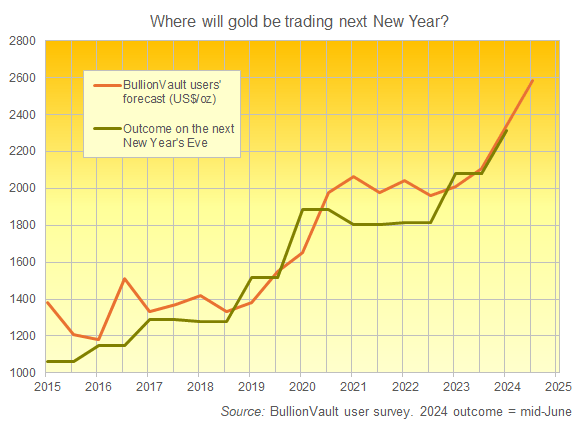

During President Trump’s first term (2017-2021), gold prices experienced notable fluctuations. In 2017, gold started the year at approximately $1,150 per ounce and ended around $1,300. The metal’s appeal as a safe-haven asset was evident amid geopolitical tensions and trade disputes initiated by the administration. The US-China trade war, characterized by escalating tariffs, led to economic uncertainties, prompting investors to flock to gold.

In 2020, the onset of the pandemic further amplified gold’s allure. The combination of economic stimulus measures, interest rate cuts by the Federal Reserve, and global economic slowdown propelled gold prices to an all-time high of over $2,000 per ounce in August 2020.

Second Term Policies and Potential Impacts on Gold Prices

As President Trump begins his second term in 2025, a series of key policy initiatives could have profound effects on gold markets. His administration’s approach to trade, fiscal policy, monetary policy, and foreign relations is expected to shape investor sentiment, potentially driving gold prices to record highs.

Trade Policies and Tariffs: Fueling Inflation and Markets Uncertainty

The Trump administration’s continued emphasis on protectionist trade measures could disrupt global supply chains and contribute to inflationary pressures—historically a key driver of gold prices. Potential tariff hikes on imports from China, the European Union, Mexico, and Canada may not only strain international trade relations but also increase the cost of goods for American consumers and businesses.

In Trump’s first term, tariffs on Chinese imports led to retaliatory measures, causing volatility in equity markets and an uptick in gold investment as a safe haven. A similar scenario in his second term could amplify these effects, with investors seeking gold as a hedge against inflation and economic instability. The unpredictability of trade negotiations may further weaken confidence in fiat currencies, driving institutional and retail investors toward gold.

Fiscal Policies and National Debt: Gold as a Hedge Against Economic Instability

Trump’s fiscal agenda—centered on tax reforms, increased infrastructure spending, and military investments—is expected to expand the national debt, which is projected to exceed $50 trillion during his second term according to some – but many others don’t agree because with economic growth, the national debt will actually decrease. America hasn’t had strong economic growth since Trump was the president before and now most Republicans think like him which was not the case during his first term.

Historically, when national debt grows unchecked, central banks and investors increase gold reserves as a hedge against the potential devaluation of paper currencies. The surge in government borrowing could also trigger inflationary concerns, making gold an attractive asset for wealth preservation. If deficit spending continues at its current pace, gold could see an even stronger rally as investors seek protection against fiscal uncertainty.

Monetary Policy and Federal Reserve Relations: A Potential Catalyst for Gold Prices

President Trump has been a vocal critic of the Federal Reserve for good reason, often pressuring the central bank to lower interest rates. If his administration continues to influence Fed policy in favor of rate cuts, this could create a favorable environment for gold.

Gold, a non-yielding asset, thrives in low-interest-rate environments, as the opportunity cost of holding gold diminishes when bond yields decline. A dovish Fed stance—whether driven by Trump’s policies or economic necessity—could significantly enhance gold’s appeal. Moreover, any uncertainty regarding the central bank’s independence could lead to increased demand for gold as investors seek stability outside the US financial system.

Geopolitical Tensions: Global Instability Driving Gold Demand

Trump’s foreign policy decisions, particularly concerning relations with China, Iran, and Russia, could escalate geopolitical risks, reinforcing gold’s status as a safe-haven asset. The potential for renewed trade wars, sanctions, and military conflicts could lead to market volatility, prompting central banks and investors to increase gold allocations.

Historically, gold prices surge during periods of geopolitical uncertainty. For example, during Trump’s first term, tensions with Iran following the US airstrike on General Qasem Soleimani in early 2020 led to a spike in gold prices even though Trump’s first term was filled with widespread peace across the world which was and is almost unheard of. Similar events in his second term—such as increased sanctions on China or military escalations in the Middle East—could once again drive gold demand higher.

Market Projections: A Bullish Outlook for Gold in Trump’s Second Term

As President Trump’s second term unfolds, financial analysts are increasingly bullish on gold, citing a confluence of economic, monetary, and geopolitical factors that could drive prices to unprecedented levels. With mounting inflation concerns, potential Federal Reserve rate cuts, and rising central bank demand, many expect gold to reach new all-time highs, making it a crucial asset for investors seeking stability.

Goldman Sachs Forecast: $3,000 Per Ounce by December 2025

Goldman Sachs, one of the most prominent investment banks, has projected that gold could reach a record-breaking $3,000 per ounce by the end of 2025. This bullish forecast is supported by a few key factors:

- Increased Central Bank Purchases– Global central banks, particularly those in China, India, and Russia, have been aggressively accumulating gold reserves to reduce their reliance on the US dollar. With continued geopolitical tensions and concerns over currency stability, this trend is expected to persist, further boosting gold demand.

- Monetary Policy Shifts– The Federal Reserve’s expected pivot towards rate cuts in response to slowing economic growth and rising debt levels could significantly enhance gold’s attractiveness. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it a preferred investment during times of monetary easing.

- Inflationary Pressures– Expansive fiscal policies under the Trump administration, including infrastructure spending and military investments, could lead to heightened inflation but this is unlikely since America is going to produce more fuel than it has ever before, reinforcing gold’s role as an inflation hedge.

Resilience of Gold-Backed ETFs: Investor Confidence in Precious Metals

Gold’s bullish trajectory is further reflected in the performance of gold-backed exchange-traded funds (ETFs), particularly the SPDR Gold Shares ETF (GLD), the largest physically-backed gold ETF in the world.

- Strong Inflows– In recent months, GLD has seen a significant increase in inflows, indicating strong investor confidence in gold as a long-term store of value.

- Price Correlation with Gold– The ETF closely tracks gold prices, and its resilience amid market volatility signals sustained interest from institutional and retail investors alike.

- Hedge Against Market Uncertainty– With equity markets facing potential turbulence under Trump’s economic policies, investors are increasingly turning to gold-backed ETFs as a hedge against stock market fluctuations.

Other Market Predictions: Is $3,000 Conservative?

While Goldman Sachs’ $3,000 projection is a headline-grabbing target, other market analysts suggest this figure could be conservative given the current macroeconomic trends. Several factors could push gold beyond this level:

- Further Dollar Weakness– A continued decline in the US dollar which is unlikely under Trump because of his America first policies, exacerbated by expanding national debt and potential trade conflicts, would make gold more attractive to foreign investors.

- Safe-Haven Demand– Any escalation in geopolitical tensions—such as conflicts involving China, Russia, or Iran—could trigger panic buying in gold, further accelerating its price surge.

- Retail and Institutional Demand– As more financial institutions and hedge funds incorporate gold into their portfolios as a defensive asset, demand could drive prices even higher than current forecasts predict.

Trust in J. Rotbart & Co for Your Precious Metal Investments

President Trump’s policies have historically had a favorable impact on gold prices, primarily through trade disputes, fiscal measures, and geopolitical strategies. As his second term unfolds, these factors are expected to continue bolstering the gold market.

Whether you are looking to diversify your portfolio with precious metals or expand your existing holdings, J. Rotbart & Co. offers a premium selection of gold, silver, platinum, and palladium in both bars and coins. Our commitment to top-tier quality and a diverse product range ensures that you will find the right investment to match your financial objectives.

Beyond offering high-quality metals, we also provide expert services in investment guidance, secure storage, lending and financing, and global shipping. No matter your precious metal needs, J. Rotbart & Co. delivers dedicated solutions to help you invest with confidence. Reach out to us today through our online contact form or write to us at [email protected] to explore your opportunities in precious metals investments.

Contact us today using our online contact form or email us at [email protected] to find out how we can help you with your gold investment needs.